Is Spotify Swimming In Green? A Deep Dive Into Its Profitability

Making a profit is earning more revenue than costs. Many companies aim to achieve this for sustainable growth and success. Spotify, a leading streaming service, is no exception.

Profitability is essential for businesses to cover expenses, invest in operations, and return value to investors. Spotify's financial performance has been a subject of interest for the music industry and its users, as it affects the platform's long-term viability and service offerings. Throughout its history, Spotify has faced challenges but has also implemented strategies to increase revenue and improve profitability.

This article will explore the question, "Is Spotify making a profit?" by examining the company's financial performance, revenue streams, and key developments.

- Few Untold Truth About Masters Of Flip

- Maureen Kelly Bio Wiki Age Height Family

- Robert Hernandez Bio Age Wiki Facts And

- Does Phaedra Parks Own A Funeral Home

- Who Is Kendra Hatcher His Wiki Details

Is Spotify Making a Profit?

Assessing Spotify's profitability encompasses various key aspects that shape the company's financial performance and long-term sustainability. Understanding these aspects provides valuable insights into Spotify's business model, revenue streams, and overall financial health.

- Revenue growth

- Cost structure

- Subscription fees

- Advertising revenue

- Gross margin

- Net income

- Cash flow

- Competition

These aspects are interconnected and influence each other. For instance, subscription fees directly impact revenue growth, while advertising revenue contributes to overall profitability. Spotify's cost structure, including expenses on music licensing and infrastructure, affects its gross margin and net income. Understanding the dynamics of these aspects provides a comprehensive view of Spotify's financial performance and its ability to generate profits.

Revenue Growth

Assessing Spotify's profitability necessitates a thorough examination of its revenue growth, a pivotal aspect that directly influences the company's ability to generate profits. Revenue growth encompasses various facets that contribute to Spotify's overall financial performance.

- Jon Batiste Bio Age Parents Wife Children

- Carter Belfort Biography Net Worth Age College

- Who Is Ciara Bravo Dating Now Past

- Debbie Cartisano Where Is Steve Cartisano S

- Who Is Corinna Kopf Biography Net Worth

- Subscription revenue: A major source of income for Spotify, subscription fees from premium users contribute significantly to the company's revenue growth. As the number of premium subscribers increases, Spotify's revenue base expands, leading to higher profitability.

- Advertising revenue: Spotify generates revenue by offering advertising space to businesses on its platform. As the number of users and listening hours grow, Spotify can command higher advertising rates, boosting its overall revenue.

- Expansion into new markets: Spotify's entry into new geographic markets presents opportunities for revenue growth. By expanding its user base to new regions, Spotify can tap into untapped markets and increase its revenue potential.

- Strategic partnerships: Spotify's collaborations with other companies, such as device manufacturers and telecom operators, can drive revenue growth. These partnerships provide Spotify with access to new distribution channels and user bases, expanding its reach and generating additional revenue streams.

Sustained revenue growth is crucial for Spotify's long-term profitability. By diversifying its revenue streams, expanding into new markets, and forming strategic partnerships, Spotify can continue to grow its revenue base and enhance its financial performance.

Cost structure

Spotify's cost structure plays a critical role in determining its profitability. The cost structure encompasses various expenses incurred by the company, including:

- Music licensing fees: Spotify pays record labels and artists for the rights to stream their music.

- Infrastructure costs: Spotify maintains a vast network of servers and data centers to support its streaming services.

- Employee salaries and benefits: Spotify employs a large workforce to manage its operations, develop new features, and provide customer support.

- Marketing and advertising expenses: Spotify invests in marketing campaigns to acquire new users and promote its services.

Spotify's cost structure has a direct impact on its profitability. Higher costs can reduce profit margins, while lower costs can improve profitability. For example, if Spotify successfully negotiates lower music licensing fees, it can increase its profit margin. Conversely, if Spotify invests heavily in marketing to acquire new users, it may experience lower profitability in the short term.

Understanding the relationship between cost structure and profitability is crucial for Spotify's long-term success. By optimizing its cost structure, Spotify can improve its profit margins and enhance its financial performance.

Subscription fees

Subscription fees are a crucial aspect of Spotify's revenue generation and profitability. They directly impact the company's ability to cover costs, invest in growth, and generate profits. Let's explore various facets of subscription fees in relation to Spotify's profitability:

- Number of subscribers: The number of premium subscribers directly affects subscription revenue. Spotify has been steadily increasing its subscriber base over the years, leading to higher revenue and improved profitability.

- Subscription price: The price of a premium subscription can impact profitability. Spotify has experimented with different pricing strategies, such as offering discounts for family plans and students. Finding the optimal subscription price is crucial for balancing revenue growth and customer acquisition costs.

- Churn rate: The churn rate measures the percentage of subscribers who cancel their subscriptions. A high churn rate can negatively impact profitability. Spotify focuses on reducing churn through various strategies, such as personalized recommendations and exclusive content.

- Payment processing fees: Spotify incurs payment processing fees when subscribers make purchases. These fees can vary depending on the payment method and region. Optimizing payment processing efficiency can improve profitability.

In summary, subscription fees are a vital component of Spotify's profitability. The company's success in acquiring and retaining subscribers, pricing its subscriptions effectively, and minimizing churn and payment processing fees is crucial for driving revenue growth and achieving long-term profitability.

Advertising revenue

Advertising revenue is a key aspect of Spotify's profitability, contributing to the company's overall financial performance. By offering advertising space to businesses on its platform, Spotify generates revenue that supplements its subscription-based income.

- Targeted advertising: Spotify uses data on user listening habits and demographics to deliver targeted advertising, making its platform more valuable to advertisers. This allows Spotify to charge higher rates for advertising space, resulting in increased revenue and profitability.

- Programmatic advertising: Spotify utilizes programmatic advertising platforms to automate the buying and selling of ad space. This process improves efficiency, reduces costs, and allows Spotify to optimize its advertising revenue.

- Exclusive advertising deals: Spotify has struck exclusive advertising deals with major brands, such as McDonald's and Coca-Cola. These deals guarantee a certain level of revenue and provide Spotify with opportunities to create custom advertising campaigns that resonate with its users.

- Podcast advertising: Spotify has expanded its advertising revenue stream through its podcast platform. By offering advertising opportunities within popular podcasts, Spotify can tap into a growing and engaged audience.

Overall, advertising revenue plays a significant role in Spotify's profitability by providing a diverse and growing revenue stream. Spotify's ability to attract advertisers, offer targeted advertising, and leverage its podcast platform contributes to its overall financial health and long-term sustainability.

Gross margin

Gross margin, a crucial indicator of a company's profitability, sheds light on Spotify's ability to generate profits from its operations. It measures the percentage of revenue left after deducting the cost of goods sold, providing insights into the efficiency of Spotify's core business. Let's delve into its key facets:

- Revenue recognition: Spotify recognizes revenue when users subscribe to its premium service or listen to ads. Understanding the timing and recognition of revenue is essential in calculating gross margin.

- Cost of revenue: Spotify incurs costs associated with music licensing fees, infrastructure, and content delivery. These costs directly impact gross margin, as higher costs reduce the margin.

- Subscription mix: The proportion of premium subscribers to ad-supported users affects gross margin. Premium subscriptions generally have a higher gross margin than ad-supported streaming, as Spotify retains a larger share of the revenue.

- Content acquisition: Spotify's investments in acquiring and licensing new music and podcasts influence gross margin. Exclusive content deals and licensing agreements can impact the cost of revenue and, consequently, gross margin.

Analyzing gross margin helps assess Spotify's pricing strategy, cost structure, and competitive landscape. It provides valuable insights into the company's ability to generate profits, manage costs, and navigate the dynamics of the streaming industry.

Net income

Net income, a crucial financial metric, plays a central role in assessing "is Spotify making a profit?". It represents the profit or loss a company earns after deducting all expenses, including cost of goods sold, operating expenses, and taxes, from its revenue. Net income provides valuable insights into Spotify's financial performance and profitability.

- Revenue: Net income starts with revenue, which Spotify generates primarily through subscription fees, advertising revenue, and other sources such as merchandise sales. Higher revenue contributes to higher net income, all else being equal.

- Cost of revenue: Spotify incurs costs associated with music licensing, infrastructure, and content delivery, which are deducted from revenue to arrive at gross profit. Lower cost of revenue relative to revenue leads to higher net income.

- Operating expenses: Spotify has various operating expenses, including marketing, research and development, and administrative costs. Controlling and optimizing operating expenses contribute to improved net income.

- Taxes: Spotify is subject to income taxes on its net income. Tax rates and deductions impact the final net income figure.

Analyzing net income helps stakeholders understand Spotify's profitability, efficiency, and overall financial health. It is a key metric used by investors, analysts, and management to make informed decisions about the company's performance and future prospects.

Cash flow

Cash flow, the lifeblood of any business, plays a critical role in determining "is Spotify making a profit?". It represents the movement of money into and out of a company, reflecting its financial health and ability to meet its obligations. Understanding the relationship between cash flow and profitability is crucial for Spotify's long-term success.

Positive cash flow indicates that Spotify is generating more cash than it is spending, allowing it to invest in growth, reduce debt, or distribute dividends to shareholders. Conversely, negative cash flow can be a sign of financial distress, as it may limit Spotify's ability to operate effectively and meet its financial obligations.

Spotify's cash flow is influenced by various factors, including subscription revenue, advertising revenue, and operating expenses. Strong subscription growth and efficient cost management contribute to positive cash flow. Spotify has also diversified its revenue streams through advertising and other initiatives to enhance its cash flow stability.

Understanding the connection between cash flow and profitability provides Spotify with valuable insights for making informed decisions. By optimizing cash flow, Spotify can improve its financial flexibility, reduce financial risks, and position itself for long-term growth. Effective cash flow management is essential for Spotify to sustain its profitability and achieve its business objectives.

Competition

Competition is a crucial aspect that shapes "is Spotify making a profit?". With numerous competitors in the music streaming market, Spotify faces challenges and opportunities that influence its profitability.

- Market: Spotify holds a significant market share in the music streaming industry. However, intense competition from rivals like Apple Music, Amazon Music, and SoundCloud can impact Spotify's subscriber growth and revenue.

- Exclusive Content: Competitors may acquire exclusive rights to distribute certain music or podcasts, differentiating their platforms and potentially attracting users away from Spotify.

- Pricing Strategies: Competitors' pricing strategies can influence Spotify's ability to attract and retain subscribers. Aggressive pricing or targeted promotions by rivals may force Spotify to adjust its pricing or offer additional incentives to maintain its competitive edge.

- Innovation: Technological advancements and new features introduced by competitors can challenge Spotify's position. Continuous innovation is crucial for Spotify to stay ahead in the competitive streaming landscape.

Understanding the competitive landscape and responding effectively to competitive pressures are key for Spotify to sustain and improve its profitability. By adapting its strategies, investing in exclusive content, and embracing innovation, Spotify can navigate the competitive market and position itself for long-term success.

Frequently Asked Questions

This section addresses common questions and provides clarifications regarding Spotify's profitability.

Question 1: How does Spotify generate revenue?

Spotify generates revenue primarily through two streams: subscription fees from premium users and advertising revenue from businesses. Additionally, it earns revenue from merchandise sales and other initiatives.

Question 2: What are Spotify's major expenses?

Spotify's significant expenses include music licensing fees, infrastructure costs, and employee salaries. Marketing and advertising expenses also contribute to its overall costs.

Question 3: How does competition affect Spotify's profitability?

Competition from other music streaming services, such as Apple Music and Amazon Music, can impact Spotify's subscriber growth and revenue. Exclusive content deals and pricing strategies adopted by competitors can also influence its profitability.

Question 4: What are Spotify's strategies for increasing profitability?

Spotify focuses on expanding its subscriber base, optimizing its cost structure, and diversifying its revenue streams. It also invests in exclusive content and technological innovation to maintain its competitive edge.

Question 5: Is Spotify currently profitable?

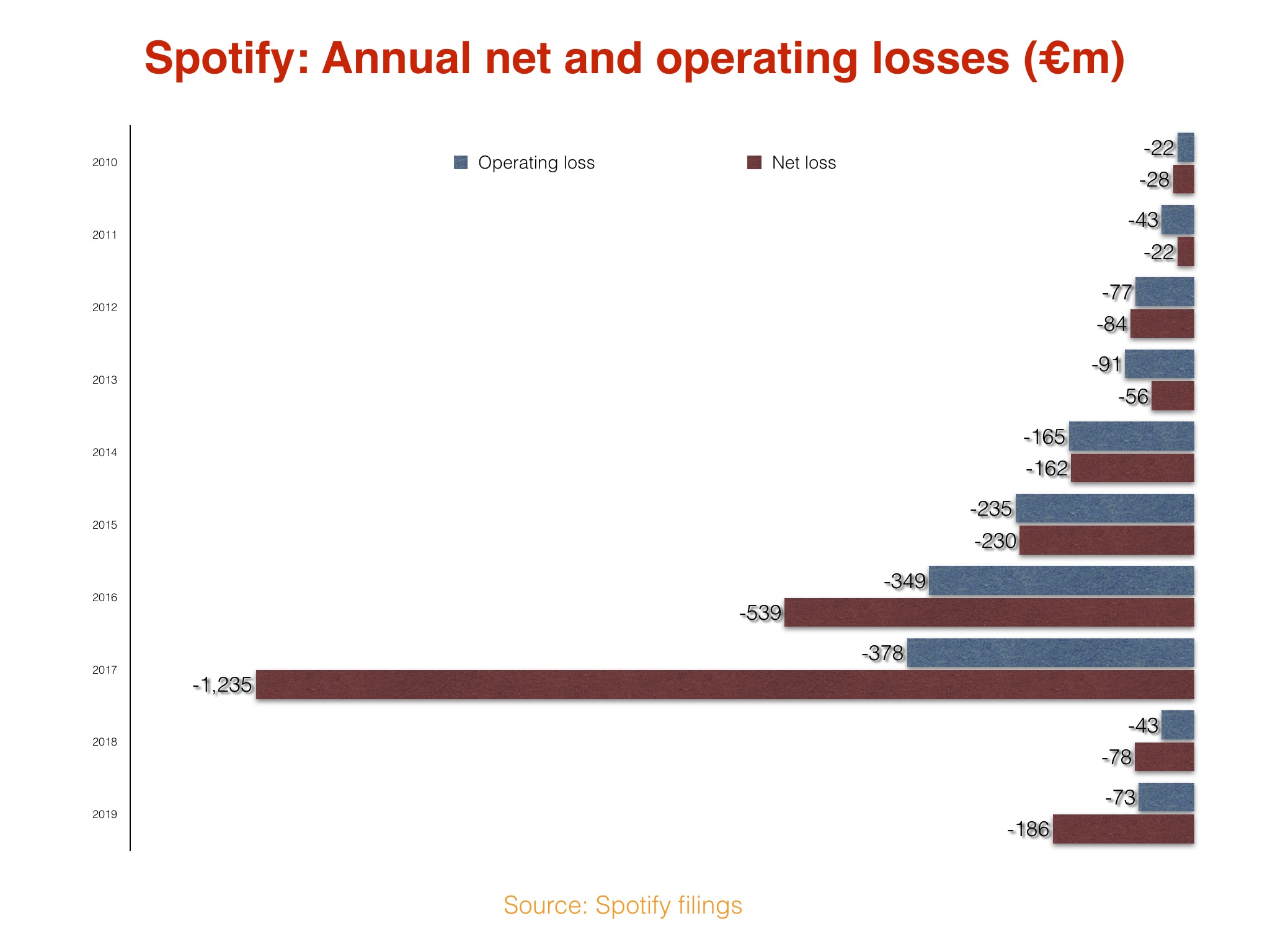

Spotify has reported both profitable and unprofitable quarters in recent years. Its profitability is influenced by various factors, including revenue growth, cost management, and competitive dynamics.

Question 6: What are the key factors that will determine Spotify's future profitability?

Spotify's future profitability will depend on its ability to retain and grow its subscriber base, effectively manage its costs, navigate competition, and embrace new technologies and revenue streams.

These FAQs provide insights into the complexities of Spotify's profitability. Understanding these factors is crucial for investors, analysts, and anyone interested in the company's financial performance.

The next section will delve deeper into Spotify's financial strategy and its implications for the future.

Tips to Maximize Spotify's Profitability

This section provides practical tips Spotify can implement to enhance its profitability and long-term financial performance.

Tip 1: Expand Subscriber Base: Spotify should focus on acquiring and retaining subscribers by offering compelling content, personalized recommendations, and exclusive features.

Tip 2: Optimize Cost Structure: Spotify can reduce unnecessary expenses without compromising service quality. This involves negotiating favorable music licensing deals and streamlining operations.

Tip 3: Diversify Revenue Streams: Expanding beyond subscription fees and advertising, Spotify can explore new revenue streams such as in-app purchases, partnerships, and merchandise sales.

Tip 4: Enhance Advertising Revenue: Spotify can increase advertising revenue by improving targeting capabilities, offering premium ad formats, and expanding its advertising inventory.

Tip 5: Invest in Exclusive Content: Acquiring exclusive rights to popular music and podcasts can differentiate Spotify from competitors and attract new subscribers.

Tip 6: Embrace Technological Innovation: Spotify should invest in cutting-edge technologies such as personalized AI recommendations, voice-activated controls, and immersive audio experiences.

Tip 7: Monitor Competition: Spotify must closely monitor competitors' strategies and respond effectively to pricing changes, exclusive content deals, and new features.

Tip 8: Explore Strategic Partnerships: Collaborations with device manufacturers, telecom operators, and other companies can expand Spotify's reach and generate additional revenue streams.

By implementing these tips, Spotify can improve its financial performance, strengthen its competitive position, and drive long-term profitability.

The following section will examine the implications of Spotify's financial strategy for the future of the music streaming industry.

Conclusion

Spotify's journey towards profitability is a complex and evolving story, shaped by various factors, including revenue growth, cost management, and competitive dynamics. Its ability to adapt to the ever-changing music streaming landscape and embrace new technologies and revenue streams will be crucial for its long-term financial success.

Key insights from our exploration include the interconnectedness of Spotify's revenue streams, expenses, and competitive environment. Understanding these interconnections is essential for stakeholders to assess the company's financial health and future prospects. Spotify's strategies for expanding its subscriber base, optimizing its cost structure, and diversifying its revenue streams will continue to play a pivotal role in its profitability journey.

- Here S How Much Mia Farrow Is

- Who Is Corinna Kopf Biography Net Worth

- Who Is Yazmina Gonzalez Meet Spencer Rattler

- Thomas Flohr Net Worth How Rich Is

- Robert Hernandez Bio Age Wiki Facts And

FileSpotify logo vertical white.jpg Wikimedia Commons

Buy Spotify Plays Famous Now ++ Click here!

Lossmaking Spotify will continue to put growth ahead of profit for