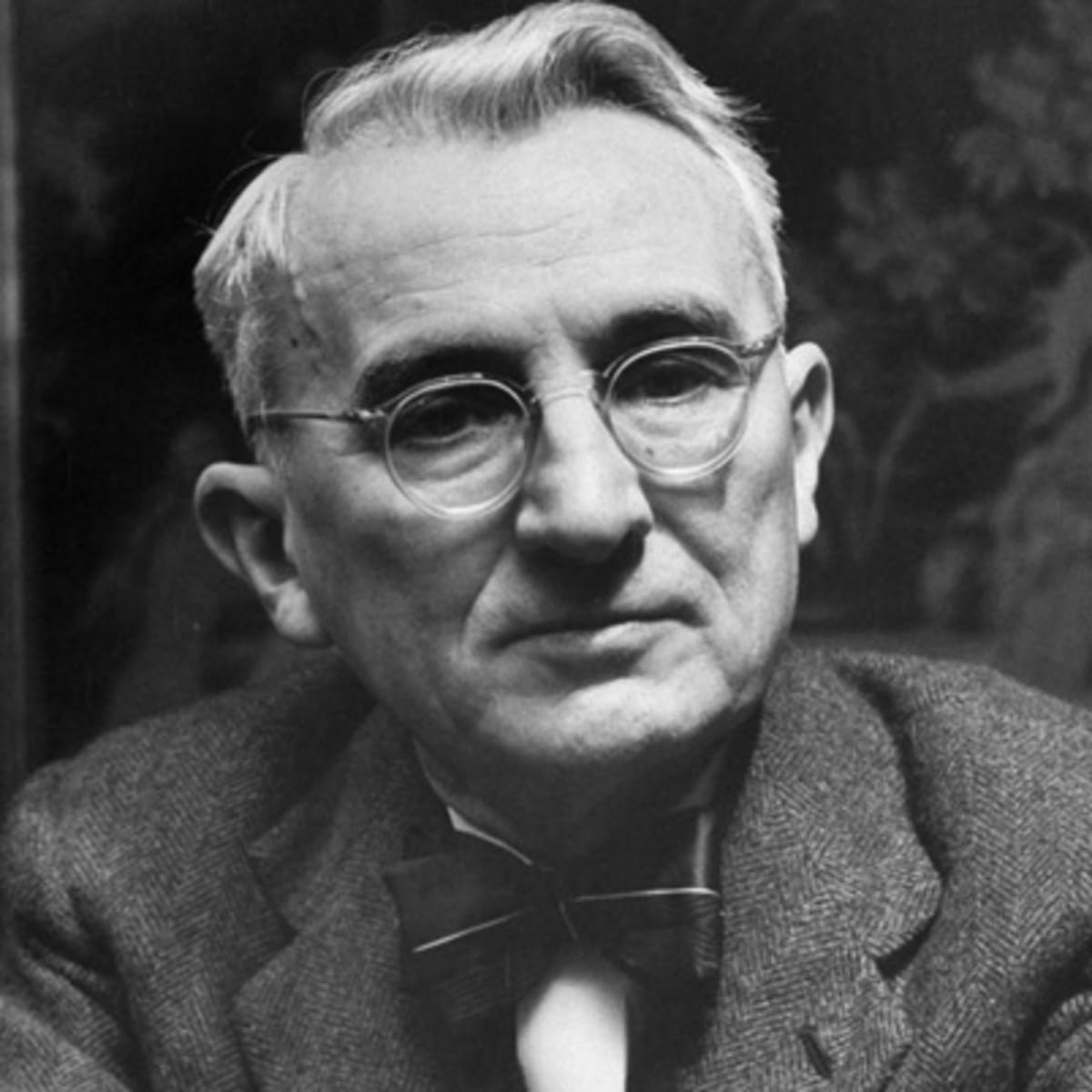

Dale Carnegie's Net Worth At The Time Of His Death: A Reflection Of Success And Legacy

"Dale Carnegie Net Worth" at Death Date" is a measure of wealth accumulated by the renowned author and motivational speaker, Dale Carnegie, until his passing. For instance, upon his demise in 1955, Carnegie left behind an estimated net worth of $2 million.

Understanding an individual's net worth at the time of their death provides insights into their financial success, lifestyle, and the impact of their work. It serves as a benchmark for assessing their wealth accumulation strategies and the legacy they leave behind. Historically, tracking net worth at death has been a common practice to gauge the financial achievements of notable figures.

This article delves into Dale Carnegie's net worth at the time of his death, exploring the factors contributing to his wealth, the impact of his work on his financial success, and the enduring legacy he left behind in the field of personal development.

- Ebony Obsidian Parents Where Are They Now

- Vick Hope Bio Age Wiki Facts And

- Who Is Sarah Jindra S Husband Brent

- Where Is Lorraine Taylor Now Is Lorraine

- Where Is Ross Caruso Going After Leaving

Dale Carnegie Net Worth At Death Date

Understanding the essential aspects of "Dale Carnegie Net Worth At Death Date" provides valuable insights into the financial success and legacy of one of the most renowned motivational speakers and authors. These key aspects include:

- Income streams: Books, lectures, consulting

- Investment strategies: Real estate, stocks, bonds

- Lifestyle expenses: Travel, entertainment, philanthropy

- Tax planning: Strategies to minimize tax liability

- Estate planning: Wills, trusts, and other arrangements

- Financial advisors: Guidance from experts in wealth management

- Economic conditions: Impact of the Great Depression on his finances

- Personal values: Emphasis on hard work, integrity, and giving back

- Legacy: Enduring impact of his work on personal development and wealth creation

These aspects collectively shaped Dale Carnegie's financial success and the legacy he left behind. His ability to generate multiple income streams, make prudent investments, and plan his estate effectively contributed to his substantial net worth at the time of his death. Carnegie's personal values and commitment to helping others extended beyond his financial achievements, as he dedicated significant resources to philanthropy and the advancement of self-improvement.

Income streams

"Income streams: Books, lectures, consulting" played a pivotal role in shaping Dale Carnegie's net worth at the time of his death. Carnegie generated substantial income through various channels, including book sales, public speaking engagements, and consulting services.

- Matt Lauer Net Worth In 2024 How

- Richard Rohr Net Worth Income Salary Earnings

- Where To Find All The Princess Quest

- Sharon Case Net Worth Husband Married Children

- Jon Batiste Bio Age Parents Wife Children

- Book sales: Carnegie's books, such as "How to Win Friends and Influence People," became bestsellers, generating significant royalties and building his reputation as an expert in personal development.

- Lectures: Carnegie conducted numerous lectures and workshops, charging fees for his appearances and sharing his insights on communication, leadership, and human relations.

- Consulting: Carnegie provided consulting services to businesses and organizations, helping them improve their communication and interpersonal skills, further supplementing his income.

These diverse income streams allowed Carnegie to accumulate wealth and establish himself as a leading figure in the field of self-help and personal growth. His ability to monetize his knowledge and expertise through multiple channels contributed significantly to his financial success and lasting legacy.

Investment strategies

"Investment strategies: Real estate, stocks, bonds" played a significant role in shaping "Dale Carnegie Net Worth At Death Date." Carnegie invested a portion of his income in a diversified portfolio of assets, including real estate, stocks, and bonds, to grow his wealth over time.

Real estate, in particular, was a key component of Carnegie's investment strategy. He purchased multiple properties, including a 23-room mansion in Forest Hills, New York, which served as both his residence and a venue for his lectures and workshops. Carnegie's real estate investments not only provided him with a steady stream of rental income but also appreciated in value over the years, contributing to his overall net worth.

In addition to real estate, Carnegie invested in stocks and bonds, seeking to capitalize on the growth potential of the stock market and the stability of fixed-income investments. By diversifying his portfolio across different asset classes, Carnegie reduced his overall investment risk and increased his chances of long-term financial success.

The practical significance of understanding the connection between "Investment strategies: Real estate, stocks, bonds," and "Dale Carnegie Net Worth At Death Date" lies in its applicability to personal finance and wealth management. Carnegie's investment strategies demonstrate the importance of diversification, risk management, and long-term planning in building and preserving wealth. By understanding the principles behind Carnegie's investment approach, individuals can make informed decisions about their own investment strategies and work towards achieving their financial goals.

Lifestyle expenses

The relationship between "Lifestyle expenses: Travel, entertainment, philanthropy" and "Dale Carnegie Net Worth At Death Date" provides valuable insights into Carnegie's financial choices and personal values. Carnegie's lifestyle expenses played a significant role in shaping his net worth and reflecting his priorities.

Carnegie dedicated a portion of his income to travel, allowing him to expand his horizons, experience diverse cultures, and connect with individuals from all walks of life. These travel expenses contributed to his personal growth and enriched his understanding of human nature, which in turn informed his work and teachings on interpersonal communication and leadership.

Carnegie also enjoyed entertaining guests, hosting lavish parties and events at his Forest Hills mansion. These entertainment expenses provided opportunities for social networking, relationship-building, and the exchange of ideas. Carnegie recognized the importance of cultivating personal connections and believed that entertainment played a vital role in fostering these relationships.

Philanthropy was an integral part of Carnegie's lifestyle. He donated generously to various charitable causes, including education, youth development, and poverty alleviation. These philanthropic expenses reflected Carnegie's commitment to giving back to society and making a positive impact on the world. By supporting organizations and initiatives that aligned with his values, Carnegie extended his legacy beyond his personal wealth and created a lasting impact on the lives of others.

Understanding the connection between "Lifestyle expenses: Travel, entertainment, philanthropy" and "Dale Carnegie Net Worth At Death Date" offers practical applications for personal finance and wealth management. Carnegie's approach to lifestyle expenses highlights the importance of balancing personal enjoyment, social connections, and charitable giving. By aligning expenses with personal values and long-term goals, individuals can create a fulfilling and financially responsible lifestyle.

Tax planning

The connection between "Tax planning: Strategies to minimize tax liability" and "Dale Carnegie Net Worth At Death Date" lies in the impact that tax planning has on an individual's overall financial position. Carnegie employed various strategies to reduce his tax liability, thereby increasing his net worth and preserving his wealth for future generations.

Tax planning is a critical component of wealth management, as it allows individuals to optimize their financial resources and maximize their net worth. By understanding the tax implications of different investment strategies, income streams, and estate planning techniques, Carnegie was able to minimize his tax burden and accumulate wealth more effectively.

One example of Carnegie's tax planning strategies was his use of charitable giving. By donating a portion of his income to qualified charities, Carnegie reduced his taxable income and received tax deductions. This allowed him to reduce his tax liability while simultaneously supporting causes that aligned with his values.

Understanding the connection between "Tax planning: Strategies to minimize tax liability" and "Dale Carnegie Net Worth At Death Date" is crucial for anyone seeking to build and preserve wealth. By implementing effective tax planning strategies, individuals can reduce their tax burden, increase their net worth, and achieve their long-term financial goals.

Estate planning

The connection between "Estate planning: Wills, trusts, and other arrangements" and "Dale Carnegie Net Worth At Death Date" lies in the importance of planning for the distribution of one's assets after death. Estate planning allows individuals to control how their wealth is managed and distributed, ensuring that their wishes are respected and their legacy is preserved.

Carnegie created a comprehensive estate plan that included a will, trusts, and other arrangements. Through his will, he designated the beneficiaries of his estate and specified how his assets should be distributed. Carnegie also established trusts to manage his assets and provide financial support for his family and charitable causes. These trusts allowed him to minimize taxes and ensure that his wealth would continue to benefit others after his death.

The practical significance of understanding the connection between "Estate planning: Wills, trusts, and other arrangements" and "Dale Carnegie Net Worth At Death Date" is that it highlights the importance of estate planning for preserving wealth and ensuring that one's final wishes are carried out. By creating an estate plan, individuals can protect their assets, provide for their loved ones, and make a lasting impact on the world through charitable giving.

In summary, estate planning is a crucial component of wealth management that allows individuals to control the distribution of their assets after death. Dale Carnegie's estate plan is an example of how effective estate planning can preserve wealth and ensure that one's legacy continues to make a positive impact on the world.

Financial advisors

The connection between "Financial advisors: Guidance from experts in wealth management" and "Dale Carnegie Net Worth At Death Date" lies in the crucial role that financial advisors play in helping individuals build, manage, and preserve their wealth. Financial advisors provide expert guidance and personalized advice, enabling individuals to make informed financial decisions and achieve their long-term financial goals.

During his lifetime, Dale Carnegie sought the guidance of financial advisors to manage his growing wealth. These advisors provided him with valuable advice on investment strategies, tax planning, and estate planning. Carnegie recognized the importance of professional financial advice and relied on his advisors to help him navigate the complexities of wealth management.

The practical significance of understanding the connection between "Financial advisors: Guidance from experts in wealth management" and "Dale Carnegie Net Worth At Death Date" is that it emphasizes the importance of seeking professional financial advice for effective wealth management. Individuals can benefit from the expertise of financial advisors to develop tailored financial plans, make informed investment decisions, and minimize their tax liability. By working with qualified financial advisors, individuals can increase their chances of achieving their financial goals and preserving their wealth for future generations.

In summary, "Financial advisors: Guidance from experts in wealth management" is a critical component of "Dale Carnegie Net Worth At Death Date." Carnegie's success in accumulating and preserving wealth can be attributed in part to the guidance he received from financial advisors. Understanding this connection highlights the importance of seeking professional financial advice for effective wealth management and achieving long-term financial goals.

Economic conditions

"Economic conditions: Impact of the Great Depression on his finances" is a significant aspect to consider when examining "Dale Carnegie Net Worth At Death Date." The Great Depression, a severe worldwide economic crisis that lasted from 1929 to 1939, had a profound impact on Carnegie's wealth and financial strategies.

- Decline in income: During the Great Depression, Carnegie's income from book sales, lectures, and consulting services declined significantly. The economic downturn led to reduced demand for his services and products, impacting his overall earnings.

- Investment losses: Carnegie's investments in the stock market and real estate also suffered during the Great Depression. The value of stocks plummeted, and real estate prices fell, resulting in substantial losses for Carnegie.

- Increased expenses: Despite the decline in income, Carnegie's expenses remained relatively stable. He continued to support his family, maintain his lifestyle, and donate to charitable causes.

- Revised financial strategies: In response to the economic challenges, Carnegie adjusted his financial strategies. He reduced his spending, explored new income streams, and sought professional advice to navigate the complexities of the Great Depression.

The Great Depression had a significant impact on Dale Carnegie's net worth at the time of his death. The decline in income, investment losses, and increased expenses during this period contributed to a reduction in his overall wealth. However, Carnegie's ability to adapt his financial strategies and seek professional guidance allowed him to preserve a substantial portion of his wealth and continue to support his family and philanthropic endeavors.

Personal values

"Personal values: Emphasis on hard work, integrity, and giving back" is an integral aspect of "Dale Carnegie Net Worth At Death Date." Carnegie's personal values had a profound impact on his financial success and the legacy he left behind.

- Hard work and dedication

Carnegie believed in the power of hard work and dedication. He spent countless hours writing, researching, and delivering lectures, tirelessly pursuing his mission of helping others improve their communication and interpersonal skills. His unwavering commitment to his work played a significant role in his financial success.

- Integrity and honesty

Carnegie was known for his integrity and honesty in all his dealings. He believed in building relationships based on trust and respect. His reputation for integrity contributed to his credibility as an author and speaker, attracting a loyal following and enhancing his earning potential.

- Philanthropy and giving back

Carnegie believed in the importance of giving back to the community. He donated generously to various charities and educational institutions, supporting causes that were close to his heart. His philanthropic efforts not only enriched the lives of others but also left a lasting legacy of social responsibility.

Carnegie's personal values were deeply ingrained in his business practices and personal life. His emphasis on hard work, integrity, and giving back contributed to his financial success and the enduring impact he had on the world. By embodying these values, he not only accumulated wealth but also left a legacy of ethical conduct and social responsibility.

Legacy

"Legacy: Enduring impact of his work on personal development and wealth creation" holds immense significance in understanding "Dale Carnegie Net Worth At Death Date." Carnegie's literary contributions and teachings on interpersonal skills have left an indelible mark on individuals and organizations worldwide, continuing to generate revenue and influence wealth creation long after his passing.

- Best-selling books

Carnegie's books, particularly "How to Win Friends and Influence People," have sold millions of copies globally, consistently ranking among the best-selling self-help books. These books continue to generate substantial royalties, contributing to his enduring legacy and net worth.

- Corporate training programs

Carnegie's principles and techniques have been widely adopted by corporations and organizations for employee training and development. Companies invest significant resources in training programs based on Carnegie's teachings, recognizing the value they bring to employee productivity and customer interactions.

- Personal growth industry

Carnegie's work has inspired a vast industry dedicated to personal growth and development. Numerous trainers, speakers, and coaches incorporate Carnegie's insights into their programs, generating revenue and contributing to the overall wealth creation in the self-help industry.

- Foundation and non-profit organizations

Carnegie established the Dale Carnegie Training Foundation, a non-profit organization dedicated to continuing his legacy by providing educational opportunities and training programs. The foundation's activities, funded in part by the proceeds from Carnegie's work, contribute to the social and economic well-being of communities.

In conclusion, the enduring impact of Dale Carnegie's work on personal development and wealth creation is evident through the continued success of his books, corporate training programs, the personal growth industry, and the philanthropic efforts of the foundation that bears his name. His legacy extends beyond monetary wealth, leaving a lasting impression on the lives of countless individuals and organizations, empowering them to achieve personal and professional growth.

In conclusion, "Dale Carnegie Net Worth At Death Date" provides valuable insights into the financial success and enduring legacy of a renowned author and motivational speaker. Carnegie's wealth was not merely a monetary value but a testament to his dedication, integrity, and commitment to helping others. His ability to generate multiple income streams, make prudent investments, and plan his estate effectively contributed to his substantial net worth. Carnegie's personal values, particularly his emphasis on hard work, integrity, and philanthropy, were deeply ingrained in his business practices and shaped his financial decisions.

The enduring impact of Carnegie's work on personal development and wealth creation cannot be overstated. Through his best-selling books, corporate training programs, and the personal growth industry he inspired, Carnegie's legacy continues to generate revenue and empower individuals to achieve personal and professional growth. His foundation's philanthropic efforts further extend his impact on society, promoting educational opportunities and social well-being.

Ultimately, the story of "Dale Carnegie Net Worth At Death Date" serves as a reminder that true wealth encompasses not only financial success but also the lasting impact one has on the world. Carnegie's legacy challenges us to reflect on our own values and aspirations, inspiring us to pursue success with integrity, dedication, and a commitment to making a positive difference in the lives of others.

- What Happened To Tina Turner S Sister

- Paula Harwood Bio Net Worth Height Career

- Vick Hope Bio Age Wiki Facts And

- Kyle Brown Wife Megan And Four Kids

- Jon Batiste Bio Age Parents Wife Children

5 Best Dale Carnegie Books (2022) That You Must Read!

5 Practical Rules to Stop Worrying by Dale Carnegie Simply Curious

Dale Carnegie feared failure before “How to Make Friends and Influence