Understanding The Ins And Outs Of "Pty" In Business

Pty, short for proprietary, is a legal term used to describe a type of business structure. In business, a proprietary company is a privately owned and operated company that is not publicly listed on a stock exchange. Examples of companies structured as proprietaries include small, family-owned businesses, sole proprietorships, and partnerships.

Proprietary companies offer many benefits, including the ability to make quick decisions, maintain complete control over the business, and maximize profits. Historically, proprietary companies were the most common form of business structure. Today, they remain popular among small business owners who value privacy and autonomy.

This article will provide a comprehensive overview of proprietary companies, discussing their advantages and disadvantages, the process of forming a proprietary company, and the legal and financial implications of this business structure.

- Who Is Jesse Watters Wife Emma Digiovine

- Joe Barry Net Worth Is He Really

- Chris Heisser Bio Age Height Net Worth

- Noah Lalonde Siblings Meet His Sister Emma

- What Happened To Mike Zobel Wife And

pty meaning in business

Understanding the essential aspects of "pty meaning in business" is crucial for navigating the complexities of proprietary business structures. These key aspects encompass various dimensions, including legal considerations, financial implications, and operational characteristics.

- Legal Structure

- Ownership and Control

- Tax Implications

- Business Formation

- Financial Management

- Decision-Making

- Growth Potential

- Exit Strategies

- Industry Considerations

These aspects are interconnected and play a significant role in shaping the success and sustainability of proprietary businesses. Understanding their implications allows business owners to make informed decisions, optimize operations, and mitigate potential risks. For example, the legal structure chosen can impact the personal liability of owners, while financial management practices can influence the availability of capital and profitability. By considering these aspects holistically, businesses can leverage the advantages of a proprietary structure while addressing its challenges.

Legal Structure

Within the context of "pty meaning in business," the legal structure of a proprietary company is a fundamental aspect that governs its operations, liabilities, and tax implications. Understanding the legal structure is crucial for business owners to make informed decisions and ensure compliance with relevant regulations.

- Denise Nicholas Age Bio Wiki Height Net

- November 14 Zodiac Horoscope Birthday Personality

- Hgtv S Designer David Bromstad Has A

- Dekenta Parchman Michigan Man 30 Who Tortured

- M I A Rapper Family Husband Children

- Entity Type

A proprietary company can be structured as a sole proprietorship, partnership, or limited liability company (LLC). Each entity type has its own legal characteristics, such as the number of owners, personal liability, and tax treatment.

- Business Registration

Proprietary companies must register with the appropriate government agencies, such as the Secretary of State or the Internal Revenue Service. Registration involves filing legal documents and obtaining necessary licenses and permits.

- Owner Liability

The legal structure of a proprietary company determines the extent of personal liability for its owners. In a sole proprietorship, the owner is personally liable for all debts and obligations of the business. In an LLC, the owners' liability is limited to their investment in the company.

- Tax Implications

The legal structure of a proprietary company also affects its tax treatment. Sole proprietorships and partnerships are generally pass-through entities, meaning that business income and losses are passed through to the owners' individual tax returns. LLCs can elect to be taxed as pass-through entities or as corporations.

Understanding the legal structure of a proprietary company is essential for business owners to navigate the legal and financial complexities of operating a business. By choosing the appropriate legal structure and complying with relevant regulations, business owners can protect their personal assets, minimize tax liability, and position their companies for success.

Ownership and Control

Ownership and control are fundamental aspects of "pty meaning in business." The structure of a proprietary company determines who owns the business, how decisions are made, and how profits are distributed. Understanding these factors is crucial for business owners to establish a clear division of responsibilities, minimize conflicts, and ensure the smooth operation of the company.

- Decision-Making Authority

In a proprietary company, the owners typically have the authority to make all major decisions regarding the business, including financial matters, hiring and firing employees, and setting strategic direction.

- Distribution of Profits

The profits of a proprietary company are distributed among the owners according to their ownership stakes. The distribution of profits can be determined by a partnership agreement or other legal document.

- Transfer of Ownership

The transfer of ownership in a proprietary company can be a complex process. In a sole proprietorship, the owner can simply sell the business. In a partnership, the transfer of ownership may require the consent of all partners.

- Dissolution of the Company

A proprietary company can be dissolved by the owners' agreement, by court order, or by operation of law. The dissolution process involves winding up the business affairs and distributing the remaining assets among the owners.

Ownership and control are key considerations for business owners when choosing a proprietary structure. The specific structure chosen will depend on the number of owners, the desired level of control, and the tax implications.

Tax Implications

Tax implications are a crucial consideration for proprietary businesses, shaping their financial decisions and overall profitability. Understanding the tax implications of a proprietary structure allows business owners to optimize their tax strategies, minimize tax liability, and ensure compliance with relevant regulations.

- Pass-Through Taxation

In many jurisdictions, proprietary companies are treated as pass-through entities for tax purposes. This means that the business's income and losses are passed through to the owners' individual tax returns, where they are taxed at the owners' individual tax rates.

- Self-Employment Taxes

Owners of proprietary companies are generally responsible for paying self-employment taxes, which include Social Security and Medicare taxes. These taxes are typically higher than the payroll taxes paid by employees.

- Business Expenses

Proprietary company owners can deduct ordinary and necessary business expenses from their business income, reducing their taxable income. Common business expenses include rent, utilities, supplies, and equipment.

- Tax-Advantaged Retirement Plans

Owners of proprietary companies can contribute to tax-advantaged retirement plans, such as IRAs and 401(k) plans. These plans allow business owners to save for retirement while reducing their current tax liability.

In summary, the tax implications of a proprietary structure are multifaceted and can significantly impact the financial performance of the business. By understanding these implications and implementing appropriate tax strategies, proprietary business owners can maximize their profitability and minimize their tax liability.

Business Formation

Business formation is a fundamental aspect of "pty meaning in business." It involves the legal and practical steps taken to establish a proprietary company. The choice of business formation structure has a significant impact on the company's legal status, tax treatment, and operational characteristics.

When forming a proprietary company, business owners must consider several key factors, including the number of owners, the desired level of personal liability, and the tax implications. The most common types of proprietary business structures are sole proprietorships, partnerships, and limited liability companies (LLCs). Each structure has its own advantages and disadvantages, and the optimal choice depends on the specific needs of the business.

In the United States, the process of business formation typically involves filing legal documents with the Secretary of State or other relevant government agency. These documents may include articles of incorporation, partnership agreements, or LLC operating agreements. Once the business is formed, it is important to obtain any necessary licenses and permits to operate legally.

Understanding the connection between business formation and "pty meaning in business" is essential for entrepreneurs and business owners. By choosing the appropriate business formation structure and following the proper legal procedures, business owners can establish a solid foundation for their companies and protect their personal assets.

Financial Management

Within the context of "pty meaning in business," financial management plays a critical role in the success and sustainability of proprietary companies. Financial management encompasses the planning, organizing, directing, and controlling of financial resources to achieve the company's objectives.

As a core component of "pty meaning in business," financial management enables proprietary companies to make informed decisions regarding their financial operations. This includes managing cash flow, allocating resources, and mitigating financial risks. Effective financial management practices can lead to increased profitability, improved cash flow, and enhanced operational efficiency.

Real-life examples of financial management within "pty meaning in business" include developing budgets and financial plans, managing accounts receivable and payable, and implementing cost-control measures. By understanding the connection between financial management and "pty meaning in business," proprietary company owners can gain valuable insights into their financial performance, identify areas for improvement, and position their businesses for long-term success.

Decision-Making

Decision-making is a pivotal aspect of "pty meaning in business," as it directly influences the success, resilience, and overall performance of proprietary companies. These companies rely heavily on the ability of their owners and managers to make sound decisions in a variety of situations.

- Strategic Planning

Involves setting long-term goals and objectives, identifying potential opportunities and threats, and developing strategies to achieve desired outcomes. Strategic planning requires a comprehensive understanding of the business environment, market trends, and competitive landscape.

- Financial Management

Pertains to decisions related to managing financial resources, including budgeting, capital allocation, and investment. Effective financial management ensures the availability and efficient use of funds to support business operations and growth.

- Operational Management

Encompasses decisions terkait daily operations, such as production, inventory management, quality control, and customer service. Making informed operational decisions helps optimize efficiency, minimize costs, and improve overall business performance.

- Risk Management

Involves identifying, assessing, and mitigating potential risks that could impact the business. Risk management enables proprietary companies to anticipate and prepare for challenges, ensuring business continuity and protecting their financial interests.

Through effective decision-making, proprietary companies can navigate the complexities of the business environment, seize growth opportunities, and overcome obstacles. Owners and managers must possess a combination of analytical skills, market knowledge, and strategic thinking to make informed decisions that drive business success.

Growth Potential

Within the context of "pty meaning in business," growth potential holds immense significance. Proprietary companies possess inherent advantages that foster growth, making it a critical component of their business model. The ability to make agile decisions, adapt to changing market dynamics, and leverage personal connections contributes to the growth potential of proprietary companies.

Real-life examples illustrate the growth potential within "pty meaning in business." Small businesses, often structured as sole proprietorships or LLCs, have demonstrated remarkable growth trajectories by capitalizing on niche markets, providing personalized services, and maintaining close customer relationships. These companies leverage their flexibility and adaptability to outmaneuver larger competitors and capture market share.

Understanding the connection between growth potential and "pty meaning in business" provides valuable insights for entrepreneurs and business owners. It highlights the importance of strategic planning, innovation, and customer-centric approaches. By embracing growth opportunities and implementing strategies that align with their unique strengths, proprietary companies can unlock their full potential and achieve long-term success.

Exit Strategies

Within the realm of "pty meaning in business," exit strategies play a pivotal role in the long-term planning and financial security of proprietary companies. An exit strategy outlines the methods through which owners and investors can divest their interests in the business and secure a return on their investment.

- Succession Planning

Involves identifying and preparing a successor to take over the business when the current owner retires or exits. Succession planning ensures a smooth transition of ownership and management.

- Sale of the Business

Involves selling the business to a third party, such as another company or an individual. Selling the business can provide a substantial financial return to the owner.

- Liquidation

Involves closing down the business and selling off its assets. Liquidation may be necessary when the business is no longer profitable or when the owner decides to retire.

- Initial Public Offering (IPO)

Involves selling shares of the business to the public through a stock exchange. An IPO can provide the business with access to capital and increase its value.

Understanding the various exit strategies available, their implications, and the factors that influence their choice empowers proprietary company owners to make informed decisions about the future of their businesses. Exit strategies are an integral part of "pty meaning in business" as they provide a roadmap for owners to realize the value of their investment and secure their financial future.

Industry Considerations

When examining "pty meaning in business," it is imperative to consider industry-specific factors that can significantly influence the success and longevity of proprietary companies. Industry Considerations encompass a wide range of aspects that shape the operating environment, competitive dynamics, and growth potential for businesses within a particular sector.

- Market Size and Growth Potential

Analyzing the size and growth potential of the industry in which a proprietary company operates is crucial. A growing industry with high demand for products or services provides ample opportunities for business expansion and profitability.

- Competitive Landscape

Understanding the competitive landscape, including the number and strength of competitors, is essential. Proprietary companies need to identify their competitive advantages and develop strategies to differentiate themselves in the market.

- Regulatory Environment

The regulatory environment of an industry can significantly impact the operations and profitability of proprietary companies. Companies must comply with industry-specific regulations, which may affect aspects such as product safety, environmental standards, and labor laws.

- Technological Advancements

Technological advancements can disrupt industries and create new opportunities for proprietary companies. Staying abreast of industry trends and adopting new technologies can provide a competitive edge and drive growth.

By carefully considering Industry Considerations, proprietary companies can make informed decisions about market entry, product development, and operational strategies. Understanding the unique characteristics and challenges of their industry empowers business owners to navigate the competitive landscape effectively, maximize their potential, and achieve long-term success.

In conclusion, our exploration of "pty meaning in business" has shed light on the fundamental aspects, implications, and considerations surrounding proprietary companies. Understanding the legal structure, ownership and control dynamics, tax implications, and financial management practices is paramount for business owners to navigate the complexities and maximize the potential of their proprietary businesses.

Key points to remember include:

- The legal structure chosen should align with the business's objectives, risk tolerance, and tax implications.

- Effective financial management is crucial for optimizing profitability, ensuring compliance, and making informed decisions.

- Industry-specific factors, such as market size, competition, and regulatory environment, can significantly impact the success and sustainability of proprietary companies.

- Executive V C Of Dallas Cowboys Charlotte

- Astrology Birth Chart Of Matthew Sturniolo Tiktok

- Who Is Corinna Kopf Biography Net Worth

- Is Wade Eastwood Related To Clint Eastwood

- Christian Kirk Wife To Be Ozzy Ozkan

:max_bytes(150000):strip_icc()/privatecompany_V2-e571ead148b643c7906455c312fb6d25.jpg)

Private Company What It Is, Types, and Pros and Cons

PTY Meaning in Urdu Urdu Translation

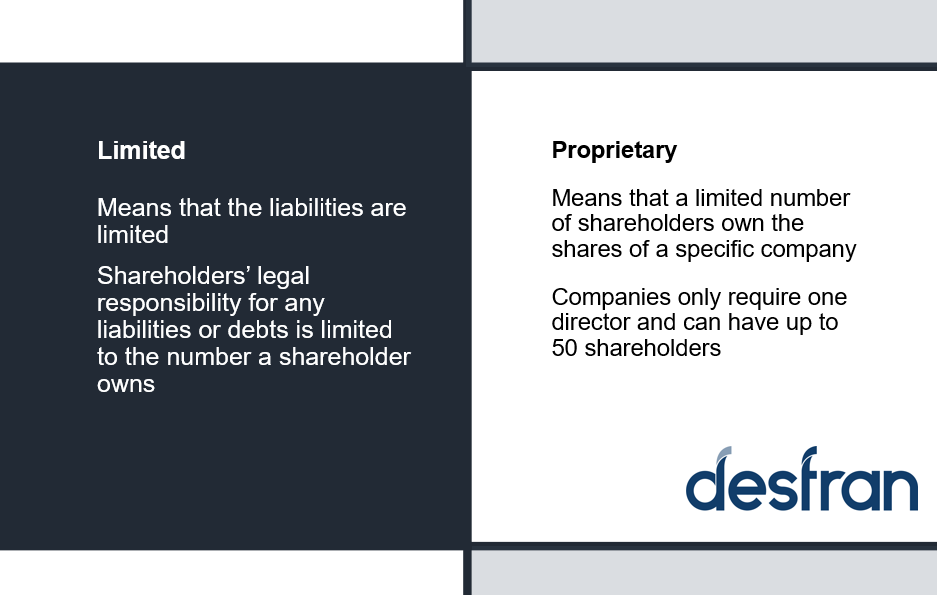

Pty & Ltd What is the difference? Desfran