Understanding "Pty Ltd" Means: A Guide To Proprietary Limited Companies In Australia

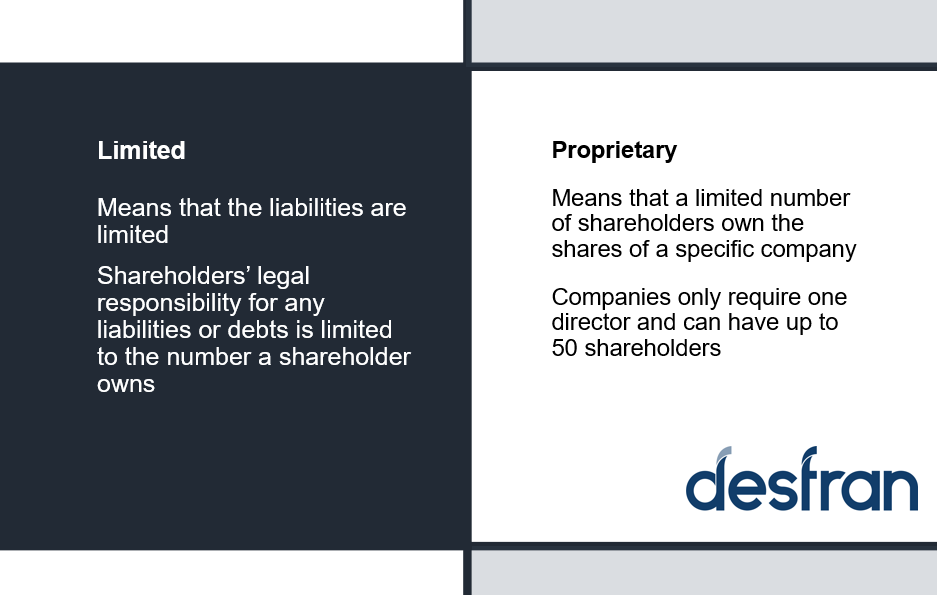

Pty Ltd means proprietary limited, a legal structure for businesses in Australia. It is a privately owned company, meaning its shareholders are liable for the company's debts up to the amount of money they have invested.

Pty Ltds are a popular business structure in Australia because they offer limited liability, and tax benefits. They also provide a level of flexibility which allows businesses to operate independently from their shareholders.

Pty Ltds have been in existence since the 19th century, and have played a significant role in the development of the Australian economy. Today, they are one of the most common business structures in the country.

- Chuck Todd And Wife Kristian Todd Married

- Chelsea Gibb Biography Age Height Husband Net

- November 14 Zodiac Horoscope Birthday Personality

- Thomas Flohr Net Worth How Rich Is

- Has Adam Lambert Been With A Woman

Pty Ltd Means

The term "pty ltd means" refers to a proprietary limited company, which is a specific type of business structure common in Australia. Understanding the key aspects of a proprietary limited company is crucial for anyone considering establishing or investing in a business in Australia.

- Legal Structure

- Limited Liability

- Shareholders

- Tax Benefits

- Flexibility

- Registration Process

- Compliance Obligations

- Dissolution

- Advantages and Disadvantages

These aspects encompass the legal, financial, and operational characteristics of a proprietary limited company. By understanding these aspects, individuals can make informed decisions about whether this business structure is suitable for their needs and goals.

Legal Structure

The legal structure of a proprietary limited company (pty ltd) in Australia is a critical component that defines its operation, rights, and responsibilities. A pty ltd is a distinct legal entity separate from its owners, providing limited liability to its shareholders. This means that the shareholders' personal assets are generally protected from the company's debts and liabilities.

- Who Is Ciara Bravo Dating Now Past

- Where Is Ross Caruso Going After Leaving

- Ryan Reynolds Brothers Meet Patrick Reynolds

- Justin Leonard Golf Channel Bio Wiki Age

- Meet Olivia Palermo Parents Douglas Palermo Lynn

The legal structure of a pty ltd is governed by the Corporations Act 2001 (Cth) and the Corporations Regulations 2001 (Cth). These regulations outline the requirements and processes for establishing and operating a pty ltd, including the appointment of directors, the issuance of shares, and the holding of meetings.

Understanding the legal structure of a pty ltd is essential for business owners and investors alike. It provides a framework for decision-making, risk management, and compliance. By adhering to the legal requirements, pty ltds can operate effectively and minimize potential legal and financial risks.

Limited Liability

Limited liability is a fundamental concept in the context of "pty ltd means" and plays a pivotal role in shaping the legal and financial landscape for businesses in Australia. A proprietary limited company (pty ltd) is a specific type of business structure that offers limited liability to its shareholders, meaning that their personal assets are generally protected from the company's debts and liabilities.

This aspect of limited liability is a critical component of pty ltd means as it provides a significant advantage to business owners. Without limited liability, shareholders would be personally liable for the company's debts and obligations, which could expose their personal assets to financial risk. Limited liability allows shareholders to invest in and operate a business with a degree of financial protection, fostering entrepreneurship and innovation.

In practice, limited liability means that if a pty ltd incurs debts or is sued, the creditors or plaintiffs can only seek compensation from the company's assets. The shareholders' personal assets, such as their homes, savings, and other investments, are generally not at risk. This provides peace of mind to business owners and encourages them to take calculated risks, knowing that their personal wealth is largely shielded from potential liabilities.

Understanding the connection between limited liability and pty ltd means is crucial for business owners, investors, and stakeholders. It empowers individuals to make informed decisions about business structures, risk management, and financial planning. By leveraging the benefits of limited liability, pty ltds can operate with greater flexibility, attract investors, and contribute to the growth and prosperity of the Australian economy.

Shareholders

In the context of "pty ltd means," shareholders are individuals or entities that own shares in a proprietary limited company. They are considered the owners of the company and hold specific rights and responsibilities.

- Ownership

Shareholders are the legal owners of the company and have a claim to its assets and profits. - Decision-Making

Shareholders have the right to vote on important company matters, such as the election of directors and changes to the company's constitution. - Financial Benefits

Shareholders are entitled to receive dividends, which are distributions of the company's profits. - Limited Liability

Shareholders have limited liability, meaning their personal assets are generally protected from the company's debts and liabilities.

Understanding the role and responsibilities of shareholders is crucial for pty ltds. Shareholders have the power to influence the direction of the company and share in its success. However, they also bear the risk of financial loss if the company fails.

Tax Benefits

Tax benefits are a significant aspect of "pty ltd means" as they provide financial advantages to proprietary limited companies in Australia. These benefits include:

- Lower Tax Rates

Pty ltds can access lower tax rates compared to other business structures, benefiting from a reduced tax burden. - Franking Credits

Pty ltds can distribute franked dividends to shareholders, allowing shareholders to claim a tax credit on the dividend income. - Capital Gains Tax Concessions

Pty ltds may qualify for capital gains tax concessions when selling assets, potentially reducing their tax liability. - Small Business Tax Exemptions

Pty ltds that meet certain criteria may be eligible for small business tax exemptions, further reducing their tax obligations.

Understanding and leveraging these tax benefits is crucial for pty ltds to optimize their financial performance. By structuring their operations and distributions strategically, pty ltds can minimize their tax liability and enjoy the benefits of a tax-efficient business structure.

Flexibility

The concept of "flexibility" holds a central position within the context of "pty ltd means," offering a range of advantages and practical benefits. As a proprietary limited company in Australia, a pty ltd structure inherently embodies flexibility, enabling businesses to adapt and respond effectively to changing market dynamics and operational requirements.

One key aspect of flexibility in the pty ltd context lies in its governance and decision-making processes. Unlike larger corporations with complex hierarchical structures, pty ltds often have streamlined management and decision-making mechanisms. This allows for greater agility in responding to market opportunities, implementing new strategies, and adapting to unforeseen circumstances.

Moreover, the flexibility of pty ltds extends to their financial management and capital structure. Pty ltds have the ability to raise capital through various means, including equity financing and debt financing. This flexibility allows them to tailor their capital structure to suit their specific business needs and growth aspirations.

In practice, the flexibility of pty ltds empowers them to navigate economic downturns, capitalize on new market opportunities, and respond swiftly to changing customer preferences. This flexibility has proven particularly valuable in recent times, as businesses have faced unprecedented challenges and disruptions due to the COVID-19 pandemic. By leveraging their inherent flexibility, pty ltds have been able to adapt their operations, pivot their business models, and emerge stronger from these challenges.

Registration Process

The registration process is a pivotal aspect of "pty ltd means" and serves as a critical component in the formation and operation of a proprietary limited company in Australia. By registering a pty ltd, individuals and entities gain access to the legal and financial benefits associated with this business structure.

The process of registering a pty ltd involves adhering to specific requirements outlined by the Australian Securities and Investments Commission (ASIC). This includes selecting a company name, appointing directors, and preparing various legal documents. ASIC reviews the submitted application and, upon approval, issues a Certificate of Registration, establishing the pty ltd as a separate legal entity.

The registration process plays a crucial role in ensuring compliance with Australian corporate law and regulations. It provides a formal framework for the company's operations, including the issuance of shares, appointment of officers, and maintenance of financial records. By completing the registration process, pty ltds gain legitimacy and recognition as a legal entity, which is essential for conducting business and entering into contracts.

Understanding the connection between the registration process and "pty ltd means" enables individuals to navigate the legal and administrative requirements involved in establishing a pty ltd. It empowers them to make informed decisions about the business structure that best suits their needs, ensuring compliance with regulatory frameworks and laying the foundation for successful business operations.

Compliance Obligations

Within the context of "pty ltd means," compliance obligations play a pivotal role in ensuring the proper functioning and legal standing of a proprietary limited company in Australia. These obligations stem from various sources, including the Corporations Act 2001 (Cth) and other relevant legislation, and are essential for maintaining the integrity and credibility of the company.

Compliance obligations encompass a wide range of responsibilities, including the timely lodgement of financial statements, adherence to tax laws, maintenance of statutory registers, and compliance with industry-specific regulations. By fulfilling these obligations, pty ltds not only avoid legal penalties but also demonstrate transparency and accountability to stakeholders, including shareholders, creditors, and regulatory authorities.

Real-life examples of compliance obligations within "pty ltd means" include:

- Maintaining a register of members, containing details of shareholders and their respective shareholdings.

- Preparing and lodging an annual financial report with ASIC, providing a comprehensive overview of the company's financial performance and position.

- Complying with taxation obligations, including the lodgement of business activity statements and payment of taxes such as income tax and goods and services tax (GST).

Understanding the practical applications of compliance obligations is crucial for pty ltds to operate effectively and avoid potential legal and financial risks. By adhering to these obligations, pty ltds can maintain a positive reputation, build trust with stakeholders, and ensure the long-term success and sustainability of their business.

Dissolution

Dissolution, within the context of "pty ltd means," encompasses the legal and procedural steps taken to wind up and terminate a proprietary limited company in Australia. This process involves various components and implications that impact the company's existence, assets, and liabilities.

- Voluntary Dissolution

When a pty ltd decides to cease operations and voluntarily dissolve, it initiates a formal process involving shareholder approval, appointment of liquidators, and distribution of assets.

- Involuntary Dissolution

In cases where a pty ltd is unable to pay its debts or meets certain criteria, creditors or regulatory authorities may initiate involuntary dissolution proceedings to wind up the company.

- Consequences of Dissolution

Upon dissolution, the pty ltd's assets are liquidated and distributed to creditors and shareholders as per the company's constitution and relevant laws. The company's legal existence ceases, and it is removed from the ASIC register.

- Tax Implications

The dissolution of a pty ltd triggers tax implications, including capital gains tax on the disposal of assets and income tax on any final distributions to shareholders.

Understanding the process and implications of dissolution is crucial for pty ltds, as it ensures a proper and orderly winding up of the company's affairs. Compliance with legal requirements and consideration of tax implications are essential to avoid potential liabilities and protect the interests of stakeholders.

Advantages and Disadvantages

Within the context of "pty ltd means," understanding the advantages and disadvantages of this business structure is crucial for informed decision-making. The choice of a pty ltd structure has significant implications for a company's legal, financial, and operational aspects.

One of the primary advantages of a pty ltd is the limited liability it offers to its shareholders. This means that the personal assets of shareholders are generally protected from the company's debts and liabilities. This advantage provides peace of mind and encourages investment and risk-taking.

However, there are also certain disadvantages associated with pty ltds. One notable disadvantage is the administrative burden and compliance requirements that come with operating as a company. Pty ltds are subject to various regulations and reporting obligations, which can be time-consuming and costly to manage.

Understanding the advantages and disadvantages of a pty ltd structure allows individuals to make informed choices about the most suitable business structure for their specific needs and goals. It is important to carefully consider the legal, financial, and operational implications before selecting a pty ltd as the preferred business structure.

In conclusion, understanding "pty ltd means" involves recognizing the legal, financial, and operational implications of a proprietary limited company structure in Australia. Key points to consider include the limited liability it offers to shareholders, the administrative burden and compliance requirements, and the advantages and disadvantages compared to other business structures.

The choice of a pty ltd structure should be carefully evaluated based on specific needs and goals. Individuals and entities should consider the legal protection, tax implications, and ongoing compliance obligations associated with this business structure. By understanding "pty ltd means," informed decisions can be made to optimize business operations and achieve long-term success.

- Tiffany Lau Bio Age Wiki Facts And

- Casey Burke Bio Age Wiki Facts And

- What Happened To Carolyn Warmus Face Brain

- Antron Brown Wife Billie Jo Brown Married

- Where Is Lorraine Taylor Now Is Lorraine

Pty & Ltd What is the difference? Desfran

What does Pty Ltd mean? YouTube

What Does PTY LTD Mean In Australia? CJ&CO