Pty Ltd Examples: A Comprehensive Guide For Business Owners

Pty ltd examples are business structures designed for companies with more than one owner, often called shareholders . These structures are common in many countries worldwide, and they provide many benefits. One key benefit is the ability to raise capital from multiple investors. In addition, shareholders can benefit from limited liability, meaning they are typically not personally responsible for the debts and obligations of the company.

Pty ltd examples have been around for centuries, and they have evolved over time to meet the changing needs of businesses. In recent years, there have been a number of important developments in the law governing these structures, making them even more attractive to businesses of all sizes.

This article will provide an overview of pty ltd examples, including their benefits, key features, and recent developments in the law governing these structures.

- What Happened To Mike Zobel Wife And

- Who Are Natasha Lyonne Parents Aaron Braunstein

- Ibrahim Chappelle Might Be Funnier Than His

- Brantley Gilbert Age Net Worth Kids Weight

- Joe Hill Is In Serious Trouble On

Pty Ltd Examples

Pty Ltd examples are an important part of the business landscape in many countries around the world. They offer a number of benefits to businesses, including the ability to raise capital from multiple investors, limited liability for shareholders, and flexibility in management.

- Shareholders

- Directors

- Company Secretary

- Registered Office

- Constitution

- Taxation

- Compliance

- Dissolution

These are just a few of the key aspects of pty ltd examples. By understanding these aspects, businesses can make informed decisions about whether or not this type of structure is right for them.

Shareholders

Shareholders are individuals or entities that own shares of a company. In a pty ltd example, shareholders are the owners of the company. They have the right to vote on important company decisions, such as the election of directors and the approval of financial statements. Shareholders also have the right to receive dividends, which are payments made by the company out of its profits.

- Denise Nicholas Age Bio Wiki Height Net

- Justin Leonard Golf Channel Bio Wiki Age

- Dr Cade Hunzeker Cause And Death How

- Harley West Bio Wikipedia Age Height Boyfriend

- Robert Hernandez Bio Age Wiki Facts And

Shareholders are a critical component of pty ltd examples. Without shareholders, a pty ltd example would not be able to raise capital or operate its business. Shareholders provide the financial backing that allows a pty ltd example to grow and succeed.

There are many real-life examples of shareholders in pty ltd examples. Some of the most well-known shareholders include Warren Buffett, Bill Gates, and Jeff Bezos. These individuals have all invested in pty ltd examples that have gone on to become some of the most successful companies in the world.

Understanding the relationship between shareholders and pty ltd examples is important for a number of reasons. First, it can help businesses to attract and retain shareholders. Second, it can help businesses to make decisions that are in the best interests of their shareholders. Third, it can help businesses to avoid legal and financial problems.

In conclusion, shareholders are a critical component of pty ltd examples. They provide the financial backing that allows these companies to grow and succeed. Understanding the relationship between shareholders and pty ltd examples is important for businesses, investors, and policymakers alike.

Directors

Directors are individuals who are responsible for the management and operation of a pty ltd example. They are elected by the shareholders and are accountable to them for the company's performance. Directors have a number of important duties and responsibilities, including:

- Decision-making

Directors are responsible for making decisions on behalf of the company. These decisions can include everything from approving the company's budget to hiring and firing employees.

- Oversight

Directors are responsible for overseeing the company's operations and ensuring that the company is run in accordance with the law and the company's constitution.

- Reporting

Directors are responsible for reporting to the shareholders on the company's performance. This reporting can include providing financial statements and other information about the company's operations.

- Compliance

Directors are responsible for ensuring that the company complies with all applicable laws and regulations.

Directors play a critical role in the success of pty ltd examples. They are responsible for making the decisions that will affect the company's future and for ensuring that the company is run in a responsible and ethical manner.

Company Secretary

Within the context of pty ltd examples, the role of Company Secretary is multifaceted, involving various responsibilities and implications. Let's delve into its key aspects:

- Appointment and Role

A Company Secretary is an individual appointed by the directors of a pty ltd example to ensure compliance with legal and regulatory requirements, maintain statutory records, and facilitate effective board governance.

- Duties and Responsibilities

Their duties include preparing and maintaining company documents, such as meeting minutes, resolutions, and share registers; advising the board on legal and governance matters; and acting as a liaison with external stakeholders, including shareholders, regulators, and auditors.

- Qualifications and Experience

Typically, a Company Secretary holds a relevant qualification in law, accounting, or corporate governance, along with experience in company administration or secretarial work.

- Consequences of Non-Compliance

Failure to appoint or maintain a qualified Company Secretary can result in legal penalties, reputational damage, and difficulties in raising capital or conducting business.

In conclusion, the role of Company Secretary in pty ltd examples is vital for ensuring adherence to legal and regulatory requirements, maintaining transparency, and facilitating smooth board operations. Their expertise and experience contribute to the overall success and reputation of the company.

Registered Office

In the context of "pty ltd examples", a Registered Office plays a pivotal role, serving as the official address of the company for legal, administrative, and communication purposes. It is required by law and holds significant implications for the company's operations, compliance, and interactions with stakeholders.

- Legal Address

A Registered Office serves as the company's legal address, determining its domicile for legal purposes and establishing its jurisdiction within a specific geographic location.

- Official Correspondence

All official correspondence, notices, and legal documents are directed to the Registered Office, ensuring that the company remains informed and responsive to important communications.

- Public Record

The Registered Office address is a matter of public record, providing transparency and allowing interested parties, such as shareholders, creditors, and regulators, to access essential information about the company.

- Service of Documents

Legal documents, such as court orders or summons, can be formally served at the Registered Office, ensuring that the company is properly notified and can respond accordingly.

In summary, the Registered Office of a pty ltd example serves as its official contact point, facilitating communication, ensuring legal compliance, and providing transparency for stakeholders. Maintaining an accurate and up-to-date Registered Office is crucial for the smooth operation and credibility of the company.

Constitution

Within the context of "pty ltd examples," the Constitution assumes a central role, serving as the foundational document that outlines the company's purpose, rules, and regulations. Its significance lies in the fact that it governs the internal operations of the company, including the rights, responsibilities, and relationships between shareholders, directors, and other stakeholders.

The Constitution is a critical component of pty ltd examples for several reasons. Firstly, it provides a clear framework for the company's operations, ensuring that all parties involved have a shared understanding of their roles and obligations. Secondly, it helps to protect the interests of shareholders by outlining their rights and entitlements, such as voting rights, dividend payments, and access to company information. Thirdly, it contributes to the overall transparency and credibility of the company, as it is a public document that can be accessed by anyone.

Real-life examples of Constitutions within pty ltd examples are abundant. One notable case is the Constitution of BHP Billiton Limited, a multinational mining, metals, and petroleum company headquartered in Melbourne, Australia. The Constitution sets out the company's purpose, powers, and objects, as well as the rights and responsibilities of its shareholders and directors.

Understanding the connection between Constitution and pty ltd examples is crucial for several reasons. Firstly, it enables stakeholders to have a clear understanding of the company's governance structure and decision-making processes. Secondly, it assists in resolving disputes or conflicts that may arise within the company, as the Constitution provides a framework for addressing such situations. Thirdly, it serves as a valuable tool for attracting investors and lenders, as a well-drafted Constitution can enhance the company's credibility and reduce perceived risks.

Taxation

Taxation plays a crucial role in the context of "pty ltd examples," influencing various aspects of their operations and financial performance. It encompasses a multifaceted framework of rules and regulations that govern the assessment, calculation, and payment of taxes by these companies.

- Taxable Income

Pty ltd examples are subject to taxation on their taxable income, which is calculated based on their revenue minus allowable deductions and expenses. Understanding the concept of taxable income is essential for accurate tax calculations and compliance.

- Tax Rates

The tax rate applicable to pty ltd examples varies depending on the jurisdiction in which they operate. Companies must be aware of the prevailing tax rates and incorporate them into their financial planning.

- Tax Obligations

Pty ltd examples have various tax obligations, including income tax, goods and services tax (GST), and payroll tax. Meeting these obligations on time and accurately is crucial to avoid penalties and maintain compliance.

- Tax Planning

Tax planning is an integral part of managing pty ltd examples. Companies can explore legitimate strategies to minimize their tax liability while remaining compliant with tax laws.

Understanding the implications of taxation on pty ltd examples is essential for their financial success and sustainability. By navigating the tax landscape effectively, companies can optimize their tax position, enhance profitability, and maintain a strong financial foundation.

Compliance

Within the context of "pty ltd examples," compliance plays a fundamental role in ensuring that companies operate within the boundaries of applicable laws and regulations. This relationship is critical to maintaining the integrity of the business environment and fostering trust among stakeholders.

Compliance encompasses various aspects, including adhering to tax laws, meeting environmental standards, and complying with employment regulations. Companies must have robust compliance frameworks in place to navigate the complex legal landscape and avoid potential legal and financial risks.

Real-life examples of compliance within pty ltd examples abound. One notable case is that of Rio Tinto, a multinational mining and metals company headquartered in Melbourne, Australia. Rio Tinto has a comprehensive compliance program that includes a Code of Conduct, ethics training, and regular audits to ensure adherence to legal requirements and ethical standards.

Understanding the practical applications of compliance for pty ltd examples is crucial for several reasons. Firstly, it helps companies avoid legal penalties, fines, and reputational damage. Secondly, it fosters a culture of integrity and transparency within the organization. Thirdly, it enhances the company's credibility and competitiveness in the marketplace.

Dissolution

Dissolution, in the context of "pty ltd examples," refers to the process of winding up and terminating the existence of a company. It marks the end of a company's legal status, involving the distribution of its assets and the settlement of its liabilities.

- Voluntary Dissolution

Voluntary dissolution occurs when the shareholders of a company decide to wind up the business voluntarily. This can happen for various reasons, such as retirement, relocation, or a change in business strategy.

- Involuntary Dissolution

Involuntary dissolution occurs when a company is wound up by order of the court. This can happen due to insolvency, breaches of the law, or other legal reasons.

- Administrative Dissolution

Administrative dissolution occurs when a company fails to comply with certain administrative requirements, such as filing annual returns or paying taxes. In this case, the company may be dissolved by the relevant government agency.

- Consequences of Dissolution

Dissolution has significant consequences, including the termination of all contracts and the distribution of assets to shareholders. Creditors must be paid off, and any remaining assets are distributed according to the company's constitution.

Understanding the concept of dissolution is crucial for pty ltd examples as it provides a clear framework for winding up a company's operations and settling its affairs. It ensures that the process is conducted in an orderly and legal manner, protecting the interests of all stakeholders involved.

In conclusion, this article has provided a comprehensive examination of "pty ltd examples," exploring their key characteristics, legal implications, and practical applications. Through an analysis of various aspects, including shareholders, directors, company secretary, registered office, constitution, taxation, compliance, and dissolution, we have gained a deeper understanding of these business structures.

Two main points emerge from this exploration: Firstly, pty ltd examples offer numerous advantages, such as limited liability, flexibility in management, and the ability to raise capital from multiple investors. Secondly, understanding the intricacies of these structures is essential for effective decision-making, ensuring compliance with legal requirements, and mitigating potential risks.

As the business landscape continues to evolve, pty ltd examples will undoubtedly remain a popular choice for many entrepreneurs and investors. By staying abreast of the latest developments in this area, businesses can harness the benefits of these structures while navigating the legal and practical complexities involved. The insights gained from this article will serve as a valuable resource for anyone seeking to establish or manage a pty ltd example.- Dorinda Medley Bio Net Worth Husband Or

- Carter Belfort Biography Net Worth Age College

- Michael Rosenbaum Dating Net Worth Tattoos Smoking

- Love Island Australia Season 4 Where Are

- Joe Barry Net Worth Is He Really

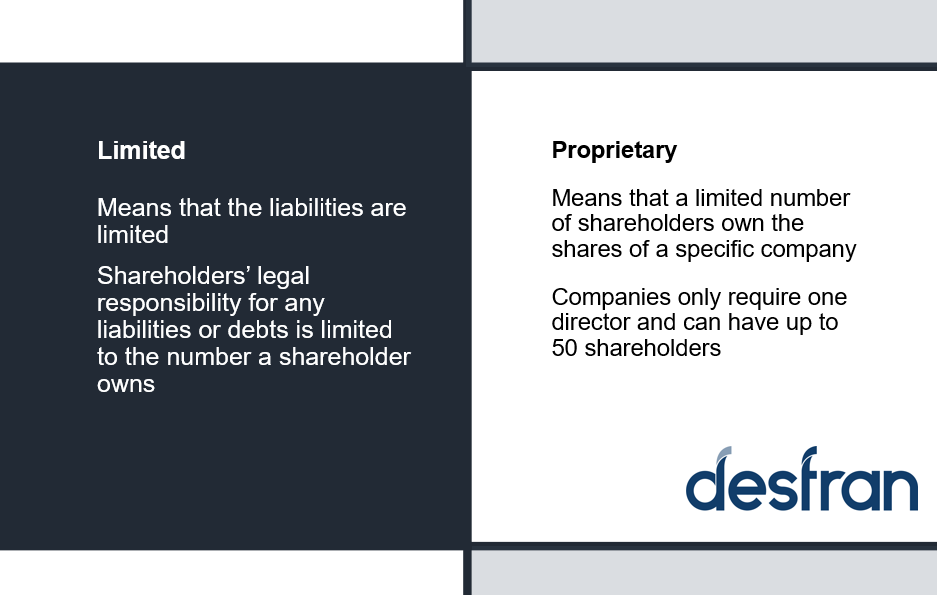

Pty & Ltd What is the difference? Desfran

Company Profile Pty Ltd

What Does Pty Ltd Mean in Australia? OpenLegal