How To Be A Successful Muni Long Parent: A Guide For Grandparents

Muni long parents are intergenerational bond investors who hold municipal bonds until maturity to earn long-term interest. An example of a muni long parent is a grandparent purchasing bonds to create a stable income stream for their grandchild's college education.

Muni long parents benefit from steady income, tax advantages, and a dependable return on investment. Historically, muni long parents evolved as an investment strategy during the 1980s when high-yield bonds became popular.

This article explores the strategies, considerations, and historical developments relevant to muni long parents, providing valuable insights for investors seeking long-term financial security.

- Christian Kirk Wife To Be Ozzy Ozkan

- Fame Mark Belling Net Worth And Salary

- Antc3b3nio Guterres Wife Meet Catarina Marques

- Xochitl Gomez Siblings Does She Have Any

- Ify Nwadiwe And Wife Aurora Has A

Muni Long Parents

Muni long parents, intergenerational bond investors, play a crucial role in the financial landscape. Their unique investment strategy requires a deep understanding of key aspects, which include:

- Municipal Bonds

- Long-Term Investment

- Steady Income

- Tax Advantages

- Grandparent-Grandchild

- College Education

- Retirement Planning

- Investment Strategies

These aspects encompass the motivations, benefits, and considerations involved in muni long parenting. By understanding these key factors, investors can make informed decisions about this investment strategy and its potential impact on their financial goals. Muni long parents provide a steady income stream, tax benefits, and the opportunity to support future generations.

Municipal Bonds

Municipal bonds are debt securities issued by state and local governments to finance infrastructure projects, such as schools, roads, and hospitals. They offer investors tax-free interest income and are considered a low-risk investment. Muni long parents are intergenerational bond investors who hold municipal bonds until maturity to earn long-term interest. Municipal bonds are a critical component of muni long parenting because they provide a steady stream of tax-free income that can be used to support future generations.

- Harley West Bio Wikipedia Age Height Boyfriend

- Heidi Russo Bio Who Is Colin Kaepernick

- Is Wade Eastwood Related To Clint Eastwood

- Young Thug S Children Know Them All

- Maureen Kelly Bio Wiki Age Height Family

For example, a grandparent may purchase municipal bonds to create a college fund for their grandchild. The interest earned on the bonds will be tax-free, and the proceeds can be used to pay for the grandchild's education. Muni long parents can also use municipal bonds to supplement their retirement income or to provide financial support to other family members.

Understanding the connection between municipal bonds and muni long parents is essential for investors who are considering this investment strategy. By investing in municipal bonds, muni long parents can earn a steady stream of tax-free income that can be used to support future generations.

Long-Term Investment

Long-term investment is a critical component of muni long parenting. Muni long parents are intergenerational bond investors who hold municipal bonds until maturity to earn long-term interest. Long-term investment allows muni long parents to lock in a steady stream of tax-free income that can be used to support future generations.

For example, a grandparent may purchase municipal bonds to create a college fund for their grandchild. The grandparent plans to hold the bonds until the grandchild is ready for college, which could be 18 years or more. By investing for the long term, the grandparent can take advantage of compounding interest and earn a higher return on their investment.

Another example of long-term investment within muni long parenting is retirement planning. A parent may purchase municipal bonds to supplement their retirement income. By investing for the long term, the parent can ensure that they will have a steady stream of income in retirement, even if they live longer than expected.

Understanding the connection between long-term investment and muni long parents is essential for investors who are considering this investment strategy. By investing for the long term, muni long parents can earn a steady stream of tax-free income that can be used to support future generations.

Steady Income

Steady income is a critical component of muni long parenting. Muni long parents are intergenerational bond investors who hold municipal bonds until maturity to earn long-term interest. Steady income is important for muni long parents because it provides a reliable source of funding for future expenses, such as college education or retirement.

For example, a grandparent may purchase municipal bonds to create a college fund for their grandchild. The interest earned on the bonds will provide a steady stream of income that can be used to pay for the grandchild's education. The grandparent can be confident that the income from the bonds will be there when they need it, regardless of market fluctuations.

Another example of steady income within muni long parenting is retirement planning. A parent may purchase municipal bonds to supplement their retirement income. The interest earned on the bonds will provide a steady stream of income that can be used to cover living expenses in retirement. The parent can be confident that the income from the bonds will be there when they need it, even if they live longer than expected.

Understanding the connection between steady income and muni long parents is essential for investors who are considering this investment strategy. By investing in municipal bonds, muni long parents can earn a steady stream of tax-free income that can be used to support future generations.

Tax Advantages

Tax advantages are a critical component of muni long parenting. Muni long parents are intergenerational bond investors who hold municipal bonds until maturity to earn long-term interest. Municipal bonds offer tax advantages because the interest earned is exempt from federal income tax and, in most cases, state and local income tax. This makes municipal bonds an attractive investment for muni long parents because it allows them to earn a higher after-tax return than they would earn from other types of investments.

For example, a grandparent may purchase municipal bonds to create a college fund for their grandchild. The interest earned on the bonds will be tax-free, which means that the grandparent will have more money available to pay for the grandchild's education. Another example of tax advantages within muni long parenting is retirement planning. A parent may purchase municipal bonds to supplement their retirement income. The interest earned on the bonds will be tax-free, which means that the parent will have more money available to cover living expenses in retirement.

Understanding the connection between tax advantages and muni long parents is essential for investors who are considering this investment strategy. By investing in municipal bonds, muni long parents can earn a higher after-tax return than they would earn from other types of investments. This can help them to reach their financial goals more quickly and easily.

Grandparent-Grandchild

Within the context of "muni long parents," the grandparent-grandchild relationship plays a crucial role. Muni long parents often invest in municipal bonds to provide long-term financial support to their grandchildren. This investment strategy can have a significant impact on the grandchild's future, helping them to achieve their educational and financial goals.

- Educational Funding

Grandparents may purchase municipal bonds to create a college fund for their grandchild. The interest earned on the bonds can be used to pay for tuition, fees, and other college expenses.

- Supplemental Income

Grandparents may also invest in municipal bonds to provide supplemental income to their grandchild. This income can be used to cover living expenses, extracurricular activities, or other expenses.

- Estate Planning

Municipal bonds can be used as part of an estate plan to pass wealth from grandparents to grandchildren. By investing in municipal bonds, grandparents can ensure that their grandchildren will receive a financial inheritance.

- Legacy Building

Investing in municipal bonds for their grandchildren can be a way for grandparents to leave a lasting legacy. By providing financial support, grandparents can help their grandchildren to achieve their goals and build a successful future.

The grandparent-grandchild relationship is a key aspect of muni long parenting. By investing in municipal bonds, grandparents can provide long-term financial support to their grandchildren, helping them to achieve their educational and financial goals.

College Education

College education plays a critical role in the lives of muni long parents and their grandchildren. Muni long parents, who are typically grandparents, invest in municipal bonds to provide long-term financial support to their grandchildren. This support often includes funding for college education.

There are several reasons why college education is a critical component of muni long parenting. First, a college education can lead to increased earning potential for grandchildren. According to the Bureau of Labor Statistics, workers with a bachelor's degree earn, on average, more than those with only a high school diploma. Second, a college education can provide grandchildren with the skills and knowledge they need to succeed in today's competitive job market. Third, a college education can help grandchildren develop critical thinking and problem-solving skills that will benefit them throughout their lives.

There are many real-life examples of muni long parents who have invested in their grandchildren's college education. One example is a grandparent who purchased municipal bonds to create a college fund for their grandchild. The interest earned on the bonds will be used to pay for the grandchild's tuition, fees, and other college expenses.

Understanding the connection between college education and muni long parents is essential for investors who are considering this investment strategy. By investing in municipal bonds, muni long parents can provide their grandchildren with the financial support they need to succeed in college and beyond.

Retirement Planning

Retirement planning is a critical component of muni long parenting, as it ensures that grandparents can continue to provide financial support to their grandchildren even after they retire. There are several key facets to retirement planning for muni long parents:

- Income Generation

Muni long parents need to ensure that they have sufficient income to support themselves and their grandchildren in retirement. This may involve investing in a combination of assets, such as municipal bonds, stocks, and real estate.

- Tax Efficiency

Muni long parents should consider tax-efficient strategies to minimize their tax liability in retirement. This may involve investing in municipal bonds, which offer tax-free interest income.

- Estate Planning

Muni long parents should have an estate plan in place to ensure that their assets are distributed according to their wishes after they pass away. This may involve creating a will or trust.

- Healthcare Planning

Muni long parents need to plan for the possibility of needing long-term care in retirement. This may involve purchasing long-term care insurance or setting aside funds to cover the cost of care.

By carefully planning for retirement, muni long parents can ensure that they can continue to provide financial support to their grandchildren throughout their lives. This can help grandchildren to achieve their educational and financial goals and live a comfortable life.

Investment Strategies

Investment strategies are a critical component of muni long parenting, as they determine how grandparents invest their money to provide long-term financial support to their grandchildren. There are several key investment strategies that muni long parents should consider:

One common investment strategy for muni long parents is to invest in a diversified portfolio of municipal bonds. Municipal bonds are debt securities issued by state and local governments to finance infrastructure projects, such as schools, roads, and hospitals. Municipal bonds offer tax-free interest income, which can be beneficial for muni long parents who are in high tax brackets.

Another investment strategy for muni long parents is to invest in growth-oriented assets, such as stocks or real estate. Growth-oriented assets have the potential to generate higher returns over time, which can help muni long parents to grow their wealth and provide more financial support to their grandchildren. However, growth-oriented assets also carry more risk than municipal bonds.

Muni long parents should work with a financial advisor to develop an investment strategy that meets their specific needs and goals. The financial advisor can help muni long parents to choose the right mix of assets and investments to achieve their financial goals.

In conclusion, muni long parents play a vital role in providing long-term financial support to their grandchildren. By understanding the key components of muni long parenting, such as municipal bonds, long-term investment, steady income, tax advantages, grandparent-grandchild relationships, college education, retirement planning, and investment strategies, grandparents can effectively plan for their grandchildren's future.

Muni long parenting involves a deep understanding of investment strategies and the ability to balance risk and reward. It also requires a commitment to long-term planning and a desire to provide financial support to future generations. By carefully considering the factors discussed in this article, muni long parents can make informed decisions that will benefit their grandchildren and their families for years to come.

- Liz Shanahan Is Michael Symon S Wife

- What Happened To Tina Turner S Sister

- Is Wade Eastwood Related To Clint Eastwood

- Adria Wu Where Is Five Star Chef

- Perry Mattfeld S Wiki Husband Height Net

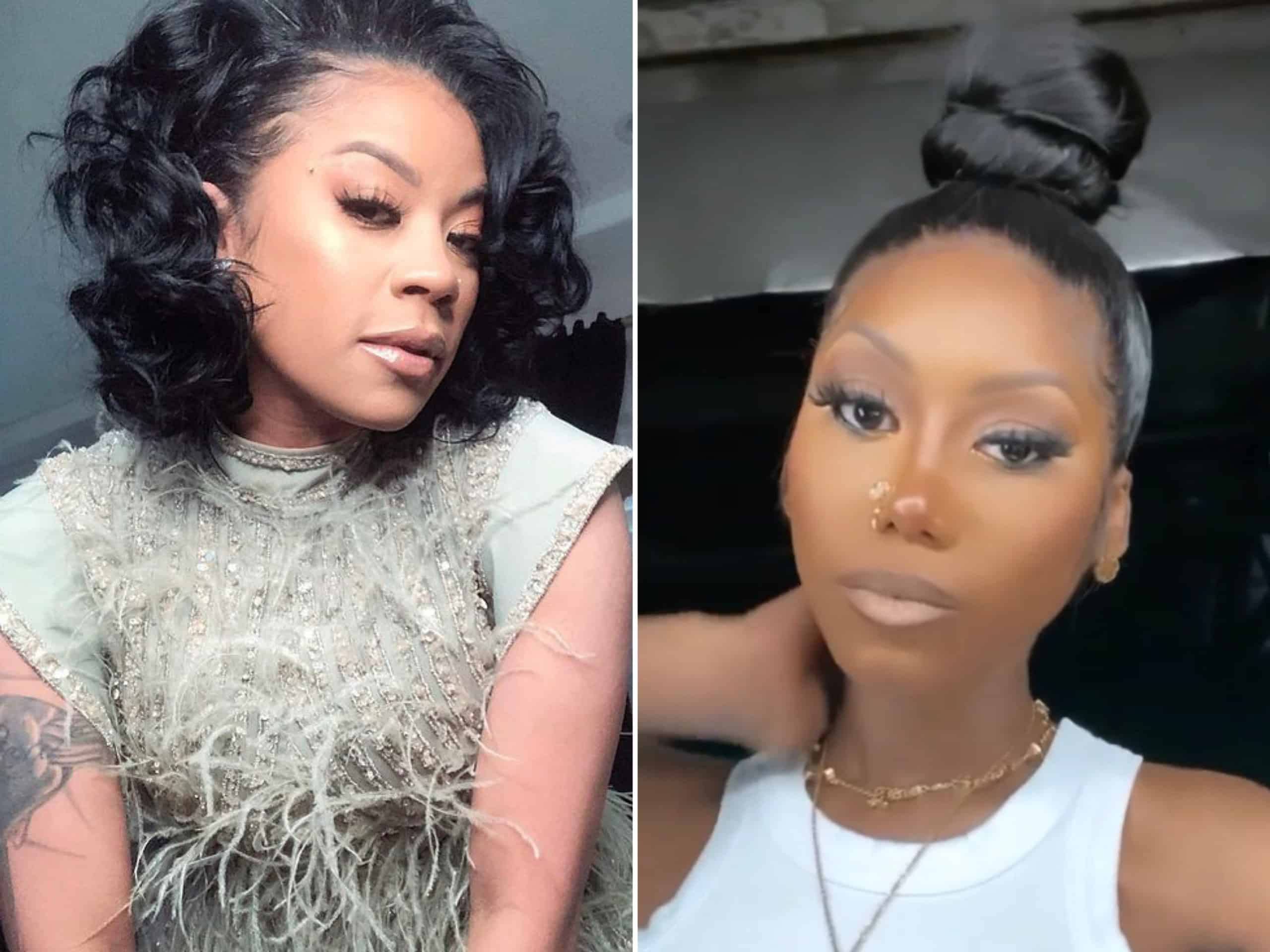

Muni Long & Keyshia Cole Speak Out After Keyshia Called Her Out For

5 Things to Know About 2023 Grammy Nominee Muni Long

On The Verge Artist Muni Long Debuts Her New Song "Another" iHeart