Louie Gohmert Net Worth: A Comprehensive Breakdown

In the financial realm, understanding the net worth of individuals holds significant importance. Net worth, defined as the value of assets minus liabilities, provides insights into a person's financial health. An example of this is the analysis of Louie Gohmert's net worth, which offers a glimpse into the financial standing of the American politician.

Determining an individual's net worth offers various benefits. It aids in assessing their financial strength, understanding their investment strategies, and evaluating their overall financial well-being. Historically, the concept of net worth has evolved from simply owning land to encompass a diverse range of assets and liabilities.

As we delve into the specifics of Louie Gohmert's net worth, we will examine the factors contributing to his financial status, analyze his investment portfolio, and assess his overall financial management strategies. This exploration will shed light on the intricacies of personal finance and provide valuable insights into the financial landscape.

- Connor Payton Is Sean Payton S Son

- November 14 Zodiac Horoscope Birthday Personality

- Virginia Madsen And Her Partner Had An

- Nico Parker Bio Age Career Height Single

- Chris Heisser Bio Age Height Net Worth

Louie Gohmert Net Worth Is The Us

Understanding the essential aspects of Louie Gohmert's net worth provides valuable insights into his financial standing and overall financial management strategies. These key aspects encompass various dimensions, including his income sources, investment portfolio, assets, liabilities, and financial goals. By examining these elements, we gain a comprehensive view of his financial well-being.

- Income Sources: Salary, investments, book deals

- Investment Portfolio: Stocks, bonds, real estate

- Assets: House, vehicles, retirement accounts

- Liabilities: Mortgage, loans, credit card debt

- Financial Goals: Retirement planning, wealth preservation

- Tax Planning: Strategies to minimize tax liability

- Estate Planning: Wills, trusts, power of attorney

- Philanthropy: Charitable giving, donations

- Business Ventures: Ownership stakes, investments

- Political Influence: Impact on financial policies

Analyzing these aspects, we can observe that Louie Gohmert's net worth is influenced by various factors, including his political career, investment decisions, and personal financial management practices. His income sources and investment portfolio provide insights into his financial growth strategies, while his assets and liabilities offer a snapshot of his current financial position. Furthermore, his financial goals, tax planning, and estate planning strategies reveal his long-term financial objectives and the steps he is taking to secure his financial future.

| Personal Details | Louie Gohmert |

|---|---|

| Birth Date | August 18, 1953 |

| Birth Place | Center, Texas, U.S. |

| Political Party | Republican |

| Spouse | Kathy Gohmert |

| Children | 3 |

| Education | Texas A&M University Baylor Law School |

| Occupation | Politician Lawyer |

Income Sources: Salary, investments, book deals

Dissecting the income sources that contribute to Louie Gohmert's net worth is crucial for comprehending his overall financial standing. His income streams encompass a diverse range of sources, including salary, investments, and book deals, each of which plays a significant role in shaping his financial landscape.

- Ibrahim Chappelle Might Be Funnier Than His

- Meet Quincy Jones 7 Kids Who Are

- Sharon Case Net Worth Husband Married Children

- Meet The Late Ray Liotta S Daughter

- Tom Sandoval Parents Meet Anthony Sandoval And

- Salary

As a United States Representative, Louie Gohmert receives an annual salary, which forms the foundation of his income. This steady income provides a stable financial base and contributes significantly to his overall net worth. - Investments

Gohmert has made strategic investments in stocks, bonds, and real estate. These investments have the potential to generate passive income and contribute to his long-term wealth accumulation. The performance of these investments can significantly impact his overall net worth. - Book Deals

Gohmert has authored several books, including "Drilling Down: How High Oil Prices Threaten Our Economy and Our Freedom" and "The Great Reset: The Coming War on Your Freedom and How to Stop It." Royalties from book sales can provide an additional source of income, contributing to his overall financial well-being.

In summary, Louie Gohmert's income sources are multifaceted, with each stream contributing to his overall net worth. Understanding the composition and performance of these income sources provides valuable insights into his financial decision-making, investment strategies, and long-term financial goals.

Investment Portfolio: Stocks, bonds, real estate

Louie Gohmert's investment portfolio, encompassing stocks, bonds, and real estate, plays a crucial role in shaping his overall net worth. The composition and performance of his investments directly impact his financial well-being and contribute to his long-term wealth accumulation strategies.

Stocks represent ownership shares in publicly traded companies, offering the potential for capital appreciation and dividend income. Bonds, on the other hand, are fixed-income securities that provide regular interest payments and a return of principal at maturity. Real estate investments, including properties and land, can generate rental income, capital gains, and tax benefits.

Real-life examples within Louie Gohmert's investment portfolio include his ownership of rental properties and investments in various stocks and bonds. The performance of these investments, influenced by market conditions and economic factors, contributes to fluctuations in his net worth over time.

Understanding the connection between Louie Gohmert's investment portfolio and his net worth is essential for several reasons. Firstly, it highlights the importance of strategic asset allocation and diversification in long-term wealth management. Secondly, it demonstrates the potential impact of investment decisions on an individual's financial trajectory. Thirdly, it underscores the need for ongoing portfolio monitoring and adjustment to align with changing financial goals and risk tolerance.

Assets: House, vehicles, retirement accounts

The relationship between Louie Gohmert's net worth and his assets, including his house, vehicles, and retirement accounts, is multifaceted. Assets play a critical role in determining an individual's overall financial health and contribute significantly to their net worth. In Louie Gohmert's case, his assets represent a substantial portion of his financial portfolio.

The value of a person's house is typically one of their most significant assets. Louie Gohmert owns a house in Tyler, Texas, which contributes to his overall net worth. The value of his house is influenced by factors such as its size, location, and condition. Appreciation in the value of his house over time can lead to a corresponding increase in his net worth.

Vehicles, while depreciating assets, can also contribute to an individual's net worth. Louie Gohmert likely owns one or more vehicles, which have a combined value that is factored into his overall net worth. The make, model, and year of his vehicles, as well as their condition, affect their value.

Retirement accounts, such as 401(k)s and IRAs, represent a crucial component ofLouie Gohmert's net worth. These accounts are designed to help individuals save for their retirement and accumulate wealth over time. The value of Louie Gohmert's retirement accounts is influenced by the amount he has contributed, the performance of the investments within those accounts, and any withdrawals he has made.

In summary, Louie Gohmert's net worth is significantly influenced by the value of his assets, including his house, vehicles, and retirement accounts. These assets represent a store of value and contribute to his overall financial well-being.

Liabilities: Mortgage, loans, credit card debt

The relationship between Louie Gohmert's net worth and his liabilities, including his mortgage, loans, and credit card debt, is a crucial aspect of his overall financial standing. Liabilities represent financial obligations that reduce an individual's net worth and can significantly impact their financial well-being.

Louie Gohmert's mortgage, which is a loan secured by his house, is likely his most substantial liability. The amount of his mortgage, as well as the interest rate and loan term, directly affects his monthly expenses and overall financial obligations. Similarly, any loans or credit card debt that Louie Gohmert has outstanding contribute to his total liabilities. High levels of debt can strain his cash flow, limit his ability to save and invest, and potentially damage his credit score.

Understanding the composition and extent of Louie Gohmert's liabilities is essential for several reasons. Firstly, it provides insights into his financial leverage and risk profile. A high debt-to-income ratio can indicate financial stress and increase the likelihood of default. Secondly, it helps assess his ability to meet his financial obligations and plan for future expenses. Thirdly, it highlights the importance of responsible debt management and the potential consequences of excessive borrowing.

In summary, Louie Gohmert's liabilities, including his mortgage, loans, and credit card debt, play a significant role in determining his net worth and overall financial health. Prudent management of liabilities is crucial for maintaining a strong financial foundation and achieving long-term financial goals.

Financial Goals: Retirement planning, wealth preservation

In the context of "Louie Gohmert Net Worth Is The Us," understanding Louie Gohmert's financial goals, particularly retirement planning and wealth preservation, is crucial for assessing his overall financial strategy and long-term financial security. These goals shape his financial decisions and influence how he manages his net worth.

- Retirement Planning

Louie Gohmert, like many individuals, likely has retirement planning as a key financial goal. This involves setting aside funds and making investment decisions to ensure a comfortable financial future after retirement. Factors such as his desired retirement age, lifestyle, and investment returns all play a role in his retirement planning strategy.

- Wealth Preservation

Wealth preservation is another important financial goal for Louie Gohmert. This involves protecting and growing his existing assets while minimizing financial risks. Strategies for wealth preservation may include diversifying investments, managing risk through insurance, and tax planning.

- Estate Planning

Estate planning is an essential aspect of wealth preservation and financial goals. It involves making arrangements for the distribution of assets after death. Through estate planning, Louie Gohmert can ensure that his assets are distributed according to his wishes and that his legacy is preserved.

- Tax Optimization

Tax optimization is a key consideration within Louie Gohmert's financial goals. By understanding and leveraging tax laws, he can minimize his tax liability and maximize his net worth. Tax optimization strategies may include utilizing tax-advantaged accounts, such as retirement accounts and charitable giving.

Overall, Louie Gohmert's financial goals of retirement planning, wealth preservation, estate planning, and tax optimization are intertwined and essential for managing his net worth effectively. These goals guide his investment decisions, risk management strategies, and long-term financial planning.

Tax Planning: Strategies to minimize tax liability

Within the context of "Louie Gohmert Net Worth Is The Us," understanding Louie Gohmert's tax planning strategies is crucial for assessing his overall financial management and net worth optimization. Effective tax planning can significantly impact an individual's financial well-being by reducing tax liability and preserving wealth.

Tax planning involves utilizing various strategies to minimize the amount of taxes owed to the government. These strategies may include maximizing tax-deductible contributions to retirement accounts, such as 401(k)s and IRAs, and utilizing tax credits and deductions to reduce taxable income. Additionally, Louie Gohmert may engage in tax-efficient investment strategies, such as investing in municipal bonds or real estate, which offer tax advantages.

By implementing comprehensive tax planning strategies, Louie Gohmert can potentially lower his tax liability, increase his disposable income, and ultimately contribute to the growth of his net worth. It is important to note that tax laws are complex and subject to change, so seeking professional tax advice is recommended to ensure compliance and optimize tax savings.

In summary, tax planning is an essential component of Louie Gohmert's financial strategy and plays a significant role in determining his net worth. By utilizing effective tax planning techniques, he can minimize his tax burden, preserve his wealth, and achieve his long-term financial goals.

Estate Planning: Wills, trusts, power of attorney

Estate planning, encompassing wills, trusts, and powers of attorney, plays a critical role in managing and preserving " Louie Gohmert Net Worth Is The Us." It ensures the orderly distribution of assets after death, minimizes estate taxes, and protects the interests of beneficiaries.

Wills are legal documents that outline an individual's wishes for the distribution of their assets upon death. Trusts are legal entities that hold and manage assets for the benefit of designated beneficiaries. Powers of attorney grant authority to a trusted individual to make financial and legal decisions on behalf of the principal, particularly in the event of incapacity.

For Louie Gohmert, estate planning is crucial for safeguarding his net worth and ensuring that his assets are distributed according to his wishes. A well-crafted will can minimize probate costs, reduce estate taxes, and prevent disputes among heirs. Trusts can be used to manage specific assets, such as real estate or investments, and provide ongoing income for beneficiaries. Powers of attorney can protect Louie Gohmert's financial interests in the event of illness or incapacity, ensuring that his assets are managed and decisions are made in accordance with his wishes.

In summary, estate planning is an essential component of Louie Gohmert's net worth management strategy. By implementing wills, trusts, and powers of attorney, he can preserve his wealth, protect his beneficiaries, and ensure that his legacy is preserved according to his intentions.

Philanthropy: Charitable giving, donations

The connection between "Philanthropy: Charitable giving, donations" and "Louie Gohmert Net Worth Is The Us" lies in the values, reputation, and legacy associated with charitable contributions. Philanthropy can enhance Louie Gohmert's net worth in several ways:

Firstly, charitable giving can lead to tax deductions, reducing his overall tax liability and potentially increasing his disposable income. By making strategic donations to qualified charitable organizations, Louie Gohmert can optimize his tax strategy and preserve more of his wealth.

Secondly, philanthropy can enhance Louie Gohmert's reputation as a socially responsible individual committed to giving back to the community. This positive public image can translate into increased support for his political career and business ventures, indirectly contributing to his overall net worth.

Real-life examples of Louie Gohmert's philanthropy include his support for organizations such as the American Red Cross and the Salvation Army. These donations demonstrate his commitment to helping those in need and align with his personal values.

In summary, while philanthropy may not directly increase Louie Gohmert's net worth in monetary terms, it plays a vital role in shaping his financial strategy, enhancing his reputation, and supporting causes that align with his values. Understanding this connection provides insights into the multifaceted nature of net worth and the importance of considering both financial and non-financial factors when assessing an individual's overall wealth.

Business Ventures: Ownership stakes, investments

Within the context of " Louie Gohmert Net Worth Is The Us," understanding his business ventures, including ownership stakes and investments, is crucial for assessing his overall financial standing and wealth accumulation strategies. Business ventures can significantly contribute to an individual's net worth and play a vital role in shaping their financial future.

Louie Gohmert's involvement in business ventures can take various forms, such as ownership stakes in companies, investments in real estate or startups, and participation in investment partnerships. These ventures represent potential sources of income and capital appreciation, which can directly impact his net worth. Successful business investments can generate profits, dividends, or returns on investment, contributing to the growth of his overall wealth.

Real-life examples of Louie Gohmert's business ventures include his ownership stake in a law firm, investments in rental properties, and involvement in various business partnerships related to real estate development and energy exploration. These ventures demonstrate his entrepreneurial spirit and provide insights into his approach to wealth creation and investment strategies.

Understanding the connection between " Business Ventures: Ownership stakes, investments" and " Louie Gohmert Net Worth Is The Us" is essential for several reasons. Firstly, it highlights the importance of business ventures as a means of generating income, accumulating wealth, and achieving financial goals. Secondly, it provides insights into Louie Gohmert's financial acumen and risk tolerance as an investor. Thirdly, it underscores the role of diversification and strategic asset allocation in managing wealth and mitigating financial risks.

Political Influence: Impact on financial policies

Louie Gohmert's political influence as a member of the U.S. House of Representatives has a significant impact on his net worth. As a politician, Gohmert has the power to influence financial policies that can directly affect his personal finances, such as tax laws, healthcare regulations, and energy policies.

For example, Gohmert's support for tax cuts and deregulation has the potential to increase his wealth through reduced tax liability and increased investment opportunities. Similarly, his opposition to environmental regulations aimed at reducing carbon emissions could benefit his investments in the oil and gas industry. Conversely, his support for social programs and increased government spending could potentially reduce his net worth through higher taxes and reduced investment returns.

Understanding the connection between political influence and net worth is essential for assessing the financial implications of Gohmert's political decisions. It also highlights the potential conflicts of interest that arise when politicians have a financial stake in the policies they are responsible for shaping.

In conclusion, this comprehensive analysis of "Louie Gohmert Net Worth Is The Us" has provided valuable insights into the multifaceted nature of net worth and its connection to various aspects of Louie Gohmert's life. Key findings include the significant impact of his income sources, investment portfolio, assets, liabilities, and financial goals on his overall net worth. Furthermore, the article highlights the interplay between his political influence and financial well-being, demonstrating the potential for conflicts of interest.

As we reflect on the significance of "Louie Gohmert Net Worth Is The Us," several main points emerge. Firstly, it underscores the importance of prudent financial management and strategic asset allocation in building and preserving wealth. Secondly, it demonstrates the influence of political power on financial outcomes, highlighting the need for transparency and accountability in policymaking. Thirdly, it serves as a reminder that net worth is not solely defined by monetary value but also encompasses personal values, philanthropic endeavors, and contributions to society.

- Emily Willis Net Worth Wiki Age Weight

- Fame Mark Belling Net Worth And Salary

- Ryan Reynolds Brothers Meet Patrick Reynolds

- Jordan Hill Net Worth Age Height Bio

- Chelsea Gibb Biography Age Height Husband Net

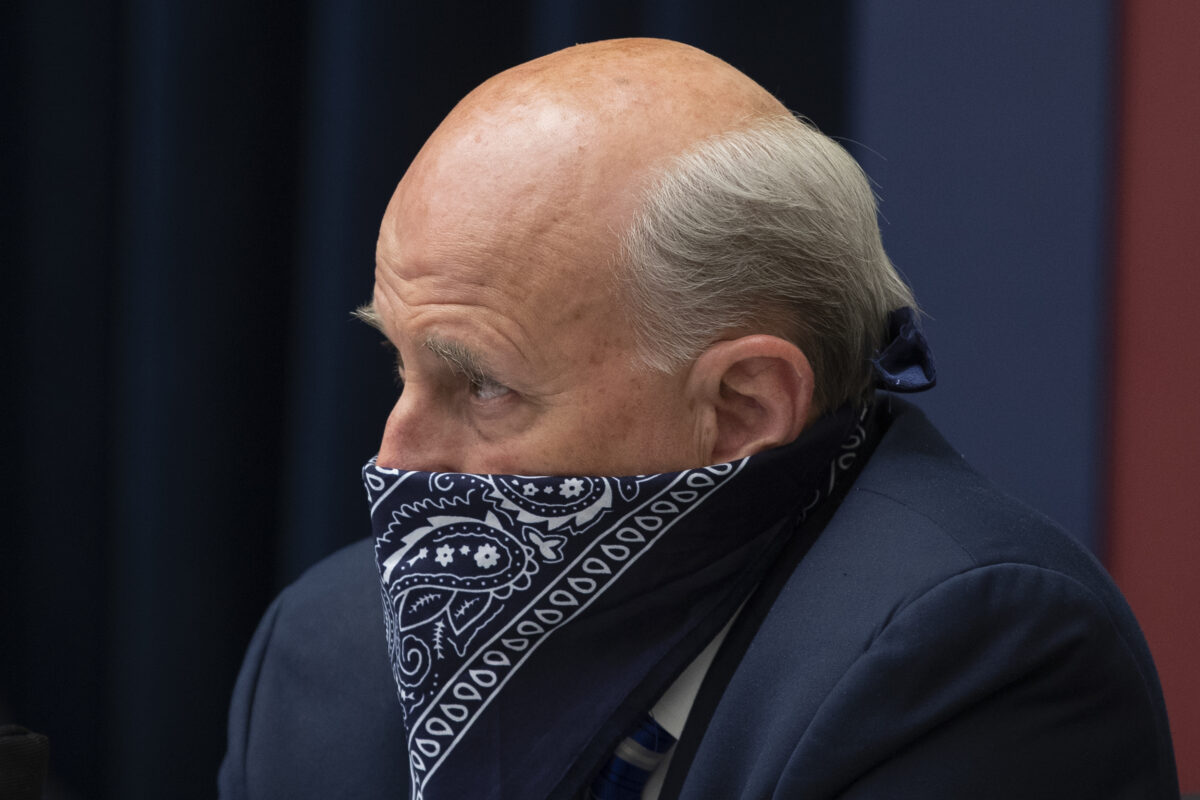

US Representative Who Tested Positive for COVID19 Says Mask May Be to

Texas Congressman says if El Paso shooter is charged with a hate crime

Elected yet unelectable Louie Gohmert A Skewed Perspective